The Federal Housing Finance Agency announced Monday that it will waive upfront fees for certain borrowers and affordable mortgage products. The agency is also moving to replace the outdated credit score model used by Fannie Mae and Freddie Mac.

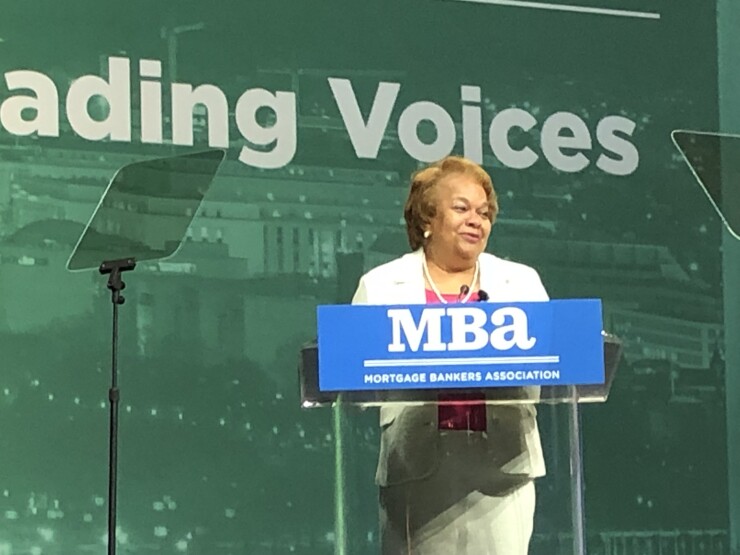

The elimination of upfront fees for underserved borrowers will go into effect as soon as possible, FHFA Director Sandra Thompson said during the Mortgage Bankers Association's annual convention in Nashville.

The transition from Classic FICO, which has been used by the enterprises for over 20 years, to FICO 10T and

"There's a lot of work that is going to have to be done to make sure that all stakeholders are well informed…," Thompson said. "We want to make sure that we take our time."

The goal behind both initiatives is to give "everyone equitable access to long-term, affordable housing opportunities, in a system that is safe, sound, and sustainable," Thompson said in prepared remarks.

Borrowers with limited resources for down payments and those in underserved communities will benefit from the announced fee elimination.

First-time homebuyers at or below 100% of area median income and below 120% AMI in high-cost areas will qualify, as well as borrowers who opt for HomeReady and Home Possible loans, which are among Fannie Mae and Freddie Mac's most affordable lending products.

The agency expects

While upfront fees for certain borrowers are being eliminated, upfront fees for cash-out refinances will be "increased modestly," starting Feb. 1, 2023. The minimal hike in upfront fees for cash-out refis will allow the agency to "manage risk exposure for the enterprises," according to a spokesperson for the FHFA.

The Community Home Lenders of America, the first trade group to respond, cheered FHFA's move.

"With skyrocketing mortgage rates and run-ups in home prices in recent years, homeownership affordability has become extremely challenging — so this announcement is well conceived and most appreciated," Scott Olson, CHLA's executive director, wrote.

In January, the FHFA announced

Olson mentioned in his letter that the CHLA wasn't happy to see higher GSE fees earlier in the year, but that after "reviewing these pricing increases, they seem consistent with a broader strategy to focus on core loans and underserved borrowers."

Regarding the transition from Classic FICO, the agency noted that significant innovations have occurred in credit score modeling, and that FICO 10T and VantageScore 4.0 will provide more accurate credit scores.

The agency dubbed the two scoring models as "more inclusive." Both models will factor in new payment histories for borrowers when available, such as rent, utilities and telecom payments.

Fannie and Freddie will require two, rather than three, credit reports from national consumer reporting agencies, which will reduce costs and further promote innovation, the agency said.

If a borrower doesn't have both credit scores, the enterprises will use a manual underwriting process, the FHFA said.