Nearly Half of Americans Plan to Shop This Weekend on Small Business Saturday, Spending an Average of $300+

After the Great Recession, American Express launched Small Business Saturday in 2010 to encourage consumers to do their after-Thanksgiving holiday shopping with small businesses. The newest LendingTree survey shows that nearly half of Americans will shop on Small Business Saturday (Nov. 27) this year, with an average expected spend of $305.

LendingTree chief credit analyst Matt Schulz believes the fallout of the coronavirus pandemic is playing a role in this desire to shop small.

“Many of these local businesses were in real danger during the pandemic, in large part because they didn’t have the business funding or resources that large national chains had to ride out the storm,” Schulz says. “Many didn’t make it, and that’s a real shame.”

Keep reading for insight into consumers’ holiday spending plans and why shopping small matters.

TABLE OF CONTENTS

Key findings

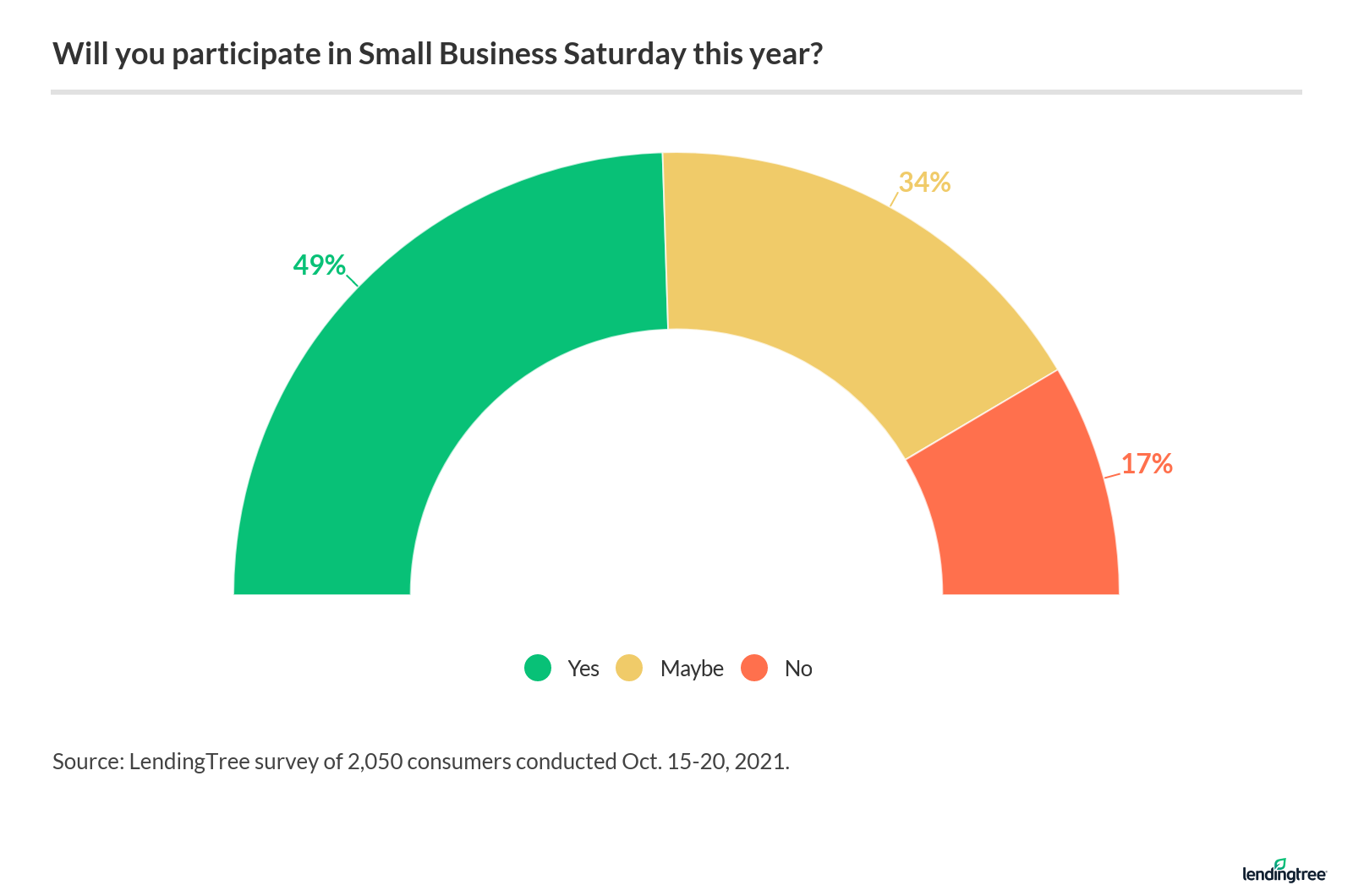

- About half (49%) of Americans plan to participate in Small Business Saturday this year, with an average expected spend of $305. That amount will likely include gifts, as 65% of consumers say they’ll purchase at least some presents at small businesses.

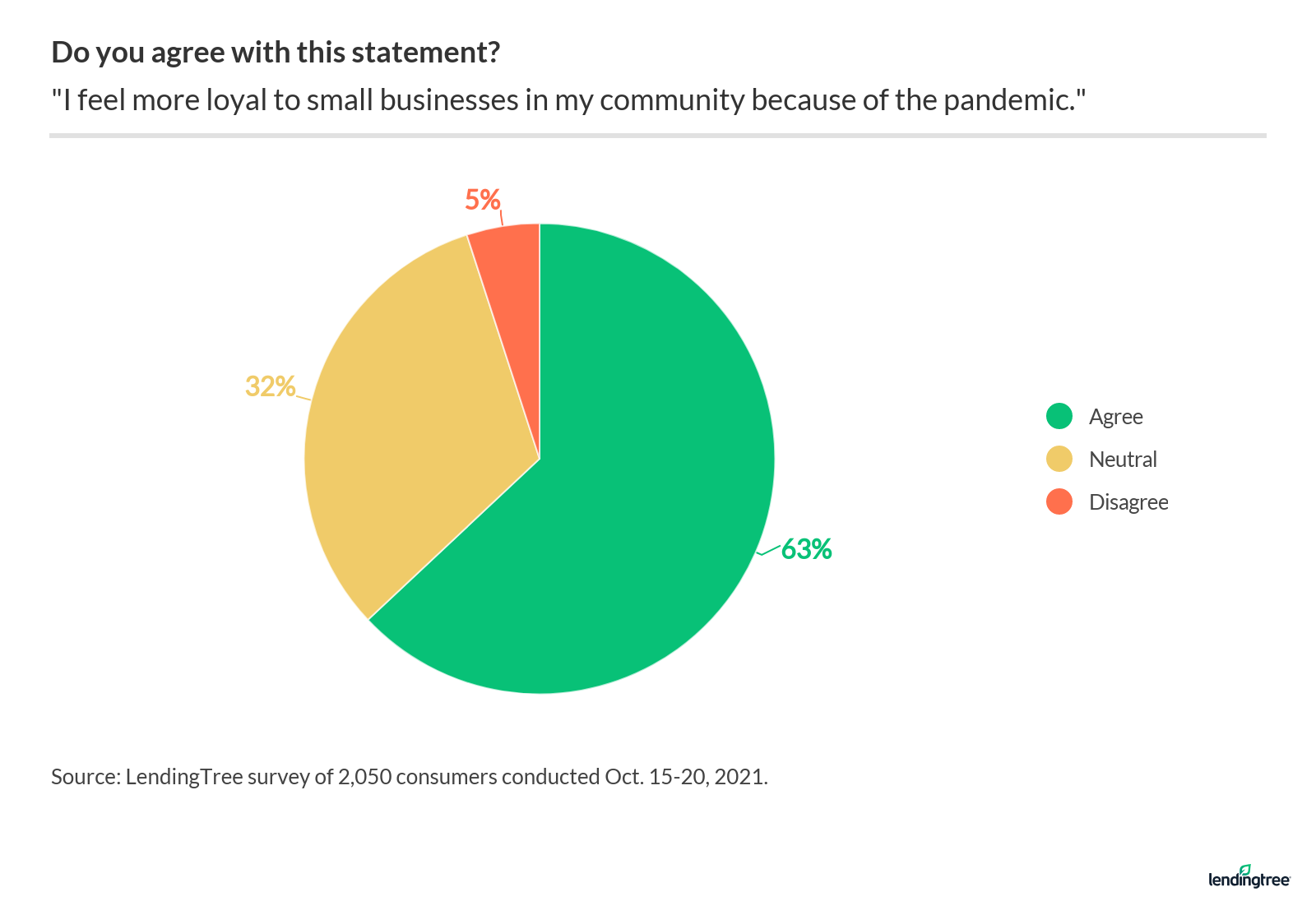

- Most consumers (63%) say the coronavirus pandemic strengthened their loyalty to small businesses. On a similar note, 49% say the pandemic made them feel more positively about small businesses in their community.

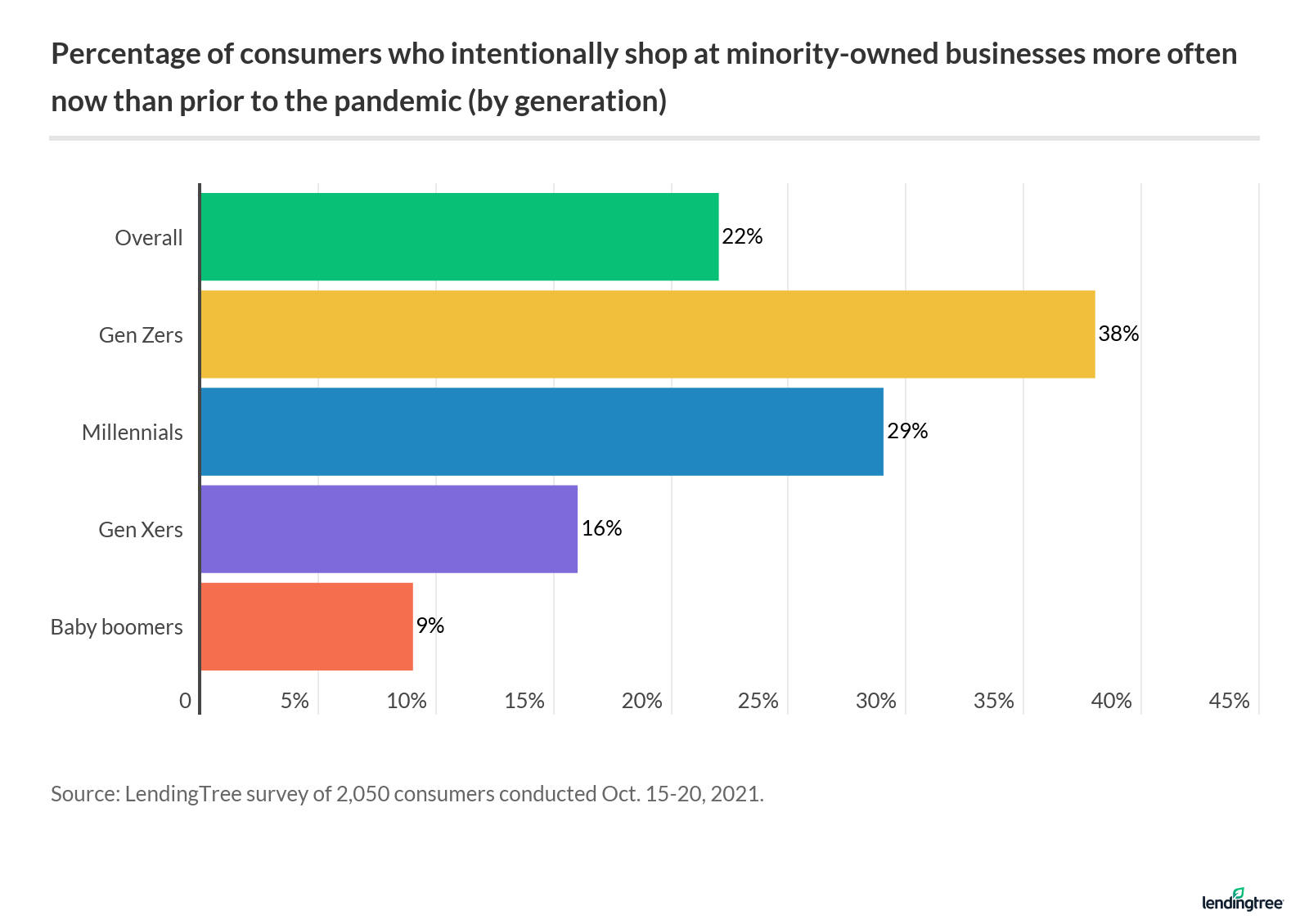

- 22% of Americans — and 38% of Gen Zers, in particular — intentionally shop at minority-owned businesses more often than they did before the pandemic. The murder of George Floyd by a police officer amid the pandemic brought heightened awareness to racial injustices, and also brought calls for Americans to support Black-owned businesses.

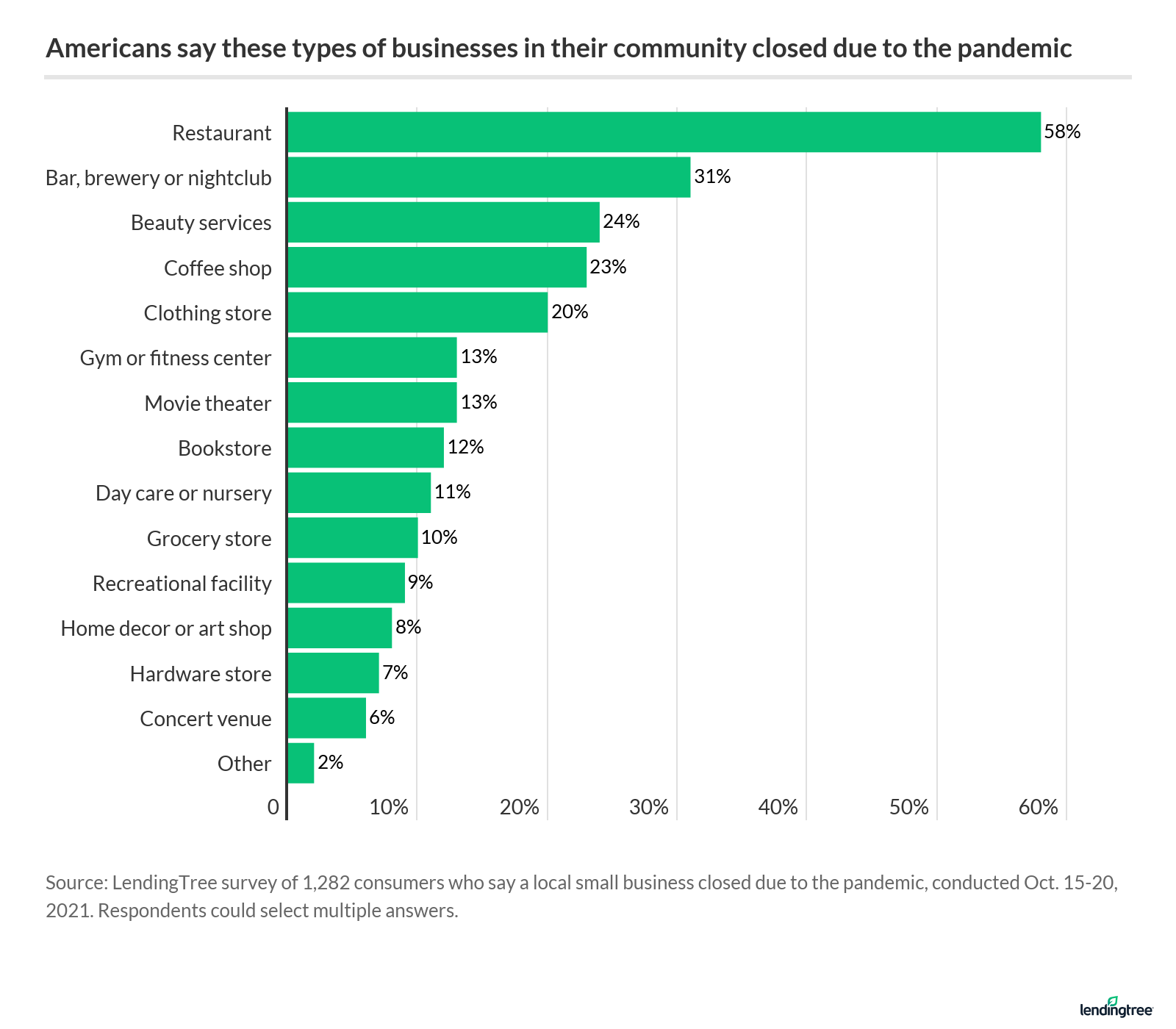

- Nearly 2 in 3 (63%) Americans know a small business in their community that permanently closed due to the pandemic. The most commonly cited closures were among restaurants (58%), bars, breweries and nightclubs (31%) and beauty services like hair or nail salons (24%).

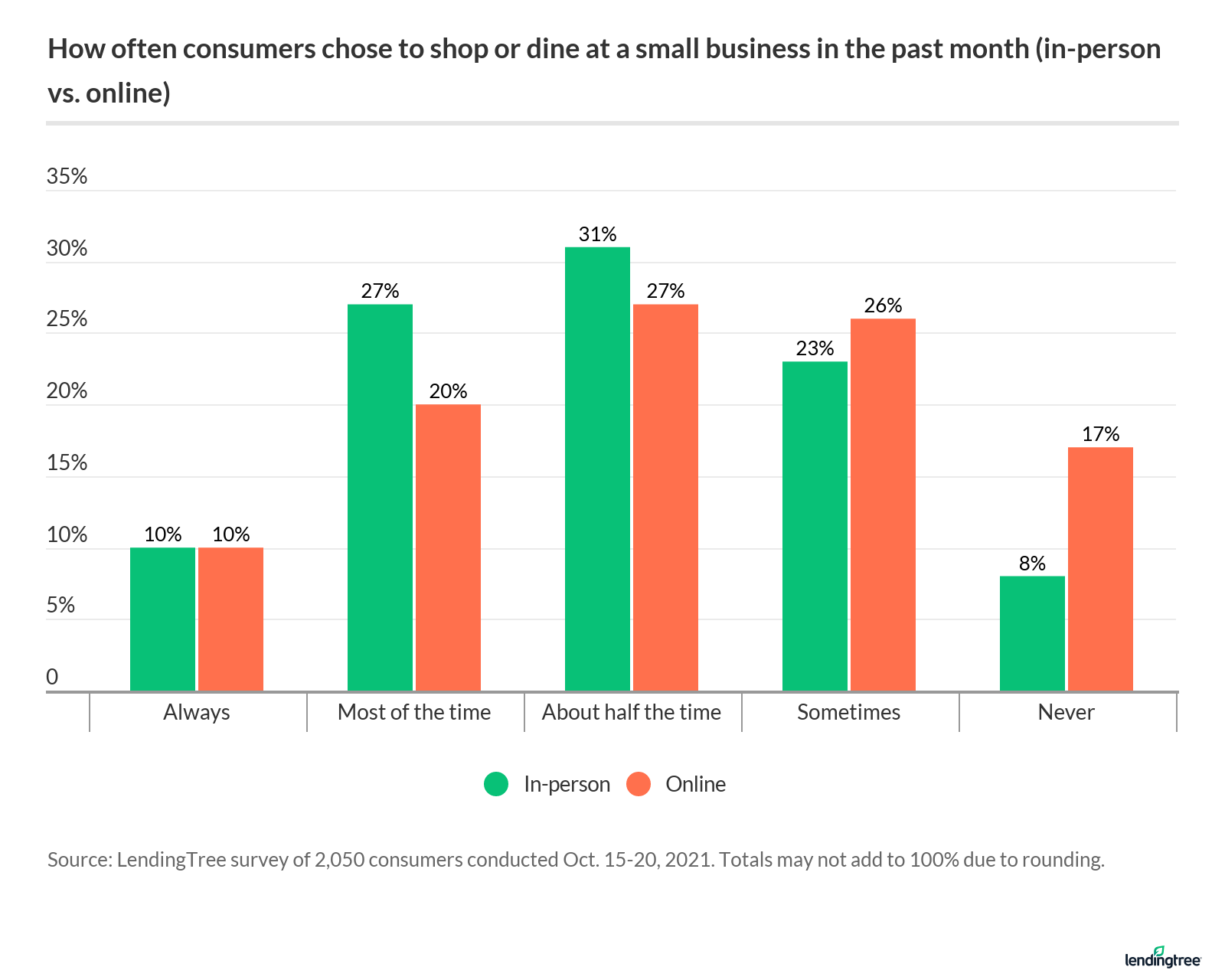

- Consumers are more likely to shop small in-person than online, and 57% believe online retailers like Amazon hurt local businesses. In the past month, 37% of Americans say they more often chose to shop or dine in-person at a small business rather than doing so at a chain store or restaurant. For Americans shopping or ordering food online, that small business preference drops to 30%.

Consumers’ Small Business Saturday plans in 2021

Almost half (49%) of Americans intend to participate in Small Business Saturday this year, with only 17% of respondents saying they don’t expect to shop small that day. Another 34% are unsure.

Meanwhile, women are more likely than men to shop small this upcoming Small Business Saturday (54% versus 43%, respectively). Plus, 59% of millennials expect to participate, highest among any of the generations.

So how much will Americans be putting down that day? Respondents expect to spend an average of $305 this Small Business Saturday.

Americans with household incomes below $35,000 are least likely to back small businesses, with 10% saying they’ll purchase their gifts exclusively from chain stores and large retailers.

How to make the most of Small Business Saturday

For those who want to support small businesses over Thanksgiving weekend, there are options.

”Shopping locally is enormously important to a community,” says Schulz. “Of course, they create jobs and help bring money into the community, but it’s more than that.”

Small, locally owned businesses, Schulz says, are part of what makes a community unique and special.

Here’s how to make the most of Small Business Saturday:

- Shop small and local: Doing so can help small businesses in your local community thrive. Shopping locally allows you to invest in your community and could help these establishments create more jobs.

- Shop online: If you don’t want to brace potential crowds, you can always support small businesses online through marketplaces like Etsy. Start following your favorite small businesses on social media so you know where to shop when the time comes.

- When in doubt, buy a gift card: Not sure where to shop? You don’t have to stick to consumer goods. You can purchase a gift card from many small businesses that provide services — Mom might really appreciate it if you cover her next couple of manicures, for instance.

Pandemic strengthens loyalty to small businesses

The majority of consumers (63%) feel more loyal to small businesses in light of the pandemic.

In particular, millennials (ages 25 to 40) are feeling the most love toward their local small businesses these days, at 70%. That’s followed by:

- Gen Zers (ages 18 to 24): 67%

- Gen Xers (ages 41 to 55): 61%

- Baby boomers (ages 56 to 75): 52%

Meanwhile, almost half (49%) report that the pandemic made them feel more positively about small businesses in their specific community. Women, Gen Zers and residents of the Northeast are most likely to say that the pandemic led them to express more positive feelings about small businesses in their area.

“Virtually every city and town in this country saw beloved businesses close down for good in the pandemic,” Schulz says (more on this soon). “That’s terrible, because when businesses like these go away, a little bit of the area’s history does, too. I think the flood of news of these closures really drove home the importance of these small businesses for people, and many folks really stepped up to try to help.”

Heightened calls to support Black- and minority-owned businesses

The death of George Floyd, who was killed in May 2020 while in police custody, gave many Americans cause for reflection. The 46-year-old Black man died after a Minneapolis police officer held his knee on Floyd’s neck for more than nine minutes. (That officer has since been found guilty on three charges, including second-degree unintentional murder.)

Amid this heightened awareness of social injustices, 22% of Americans report intentionally shopping at minority-owned businesses more often than they did before the pandemic.

Gen Zers, in particular, want to show their support, with 38% reporting they’re shopping at minority-owned businesses more frequently now, compared with:

- 29% of millennials

- 16% of Gen Xers

- 9% of baby boomers

On the other hand, Gen Zers also have the highest percentage (7%) of Americans who intentionally shop less at these businesses than before the pandemic.

Despite this loyalty, many saw the closure of small businesses in their community

Many businesses were up against an unfair fight once the pandemic hit, Schulz says. They simply didn’t have the resources they needed to be able to hang on, and while many businesses did what they could to adjust to the new realities of running a business in a pandemic, they couldn’t keep up.

In fact, 63% of Americans saw at least one small business in their local community close due to the pandemic. The closings they witnessed were in a number of different industries, including restaurants (58%), bars, breweries and nightclubs (31%) and beauty services like hair or nail salons (24%).

In-person vs. online: How consumers view small businesses

One in 10 Americans say they “always” chose small businesses over chains in the past month when shopping or dining in-person or shopping or ordering food online. When combined with a “most of the time” option, more Americans lean toward small businesses as in-person options (37%) than online ones (30%).

By generation, 15% of Gen Zers always chose small businesses over chain stores in the past month, whether it was in-person or online.

Now that we have a better idea of how consumers feel about small businesses, how do they feel about large ones? Many feel large businesses are actively harming small ones — more than half (57%) believe that online retailers like Amazon hurt local businesses, with baby boomers especially sharing this sentiment (at 67%).

How small businesses can pull in more shoppers, diners

“It’s been such a difficult two years,” says Schulz. “However, the fact that a greater appreciation for the importance of local small business has come out of it is a very good thing.”

Schulz says it remains to be seen whether this support will last once the pandemic ends, whenever that is.

For small business owners looking to attract more customers, there are a few steps they can take. Consumers say that lower prices (52%) and closer proximity to their homes or work (47%) would cause them to visit small businesses more frequently.

While it may not be possible to lower prices or improve location, there are some other actionable steps small businesses can take, including:

- Special promotions (37%)

- More choice in terms of inventory (31%)

- Stories about the owners (17%)

- Clear signage indicating it’s a small business (16%)

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,050 U.S. consumers from Oct. 15 to Oct. 20, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.