If you lost your job, here’s how to find free health insurance

Dear Liz: I have read that the unemployed can qualify for free health insurance through the Affordable Care Act exchanges. I’m trying to confirm whether my state, which did not accept expanded Medicaid coverage, is offering this to its residents. My position was eliminated with no warning because of the pandemic and I’m finding Healthcare.gov rather convoluted to navigate.

Answer: It may be July before the ACA exchanges reflect the extra tax credits that will make comprehensive health insurance free for anyone who receives unemployment benefits in 2021.

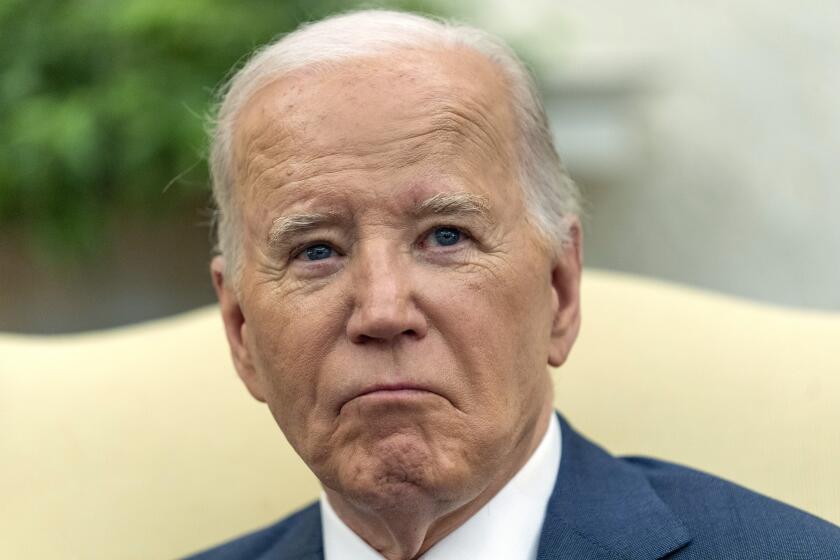

Some of the health insurance changes authorized by the American Rescue Plan, which President Biden signed in March, went into effect April 1. Those included providing larger tax credits that lowered costs for most people who buy health insurance on the exchanges and increasing the number of people who qualify for those premium-reducing credits.

In the past, people with incomes above 400% of the poverty line typically didn’t qualify for subsidies that lowered their costs, but now people with incomes up to 600% of the poverty line — up to $76,560 for a single person or $157,200 for a family of four — can qualify, according to medical research organization KFF (formerly Kaiser Family Foundation). The law also created a new special enrollment period that extends through Aug. 15, 2021.

The exchanges have been slower to reflect the increased tax credits for people who receive unemployment benefits at any point during 2021. These credits will effectively allow those who don’t have access to other group coverage to qualify for a free silver plan with a $177 deductible. The U.S. Centers for Medicare and Medicaid Services has promised that the credits “will be available starting this summer.”

You shouldn’t be without health insurance, so you could sign up for coverage now and update your information when the increased tax credits become available.

But you may have another option. The American Rescue Plan also requires employers to provide free COBRA coverage from April 1 through Sept. 30 to eligible former employees who lost their healthcare coverage because of involuntary termination or a reduction in hours. (Employers will get a federal tax credit to cover their costs.)

Even if you turned down COBRA coverage when you lost your job — as many people do because it’s so expensive — you could still get free coverage if it hasn’t been more than 18 months since you lost your job. Employers are required to notify eligible former employees by May 31. If you haven’t heard from yours by then but think you’re eligible, reach out to the company’s human resources department.

Want PPP loan forgiveness? Here’s a look at the application process and tips on what small businesses can do to improve their chances.

Taxes on a home sale

Dear Liz: My wife wants to sell our home of three years for a $300,000 profit after an extensive remodel and move into our rental home. She wants to stay there for two years and then sell to take advantage of the capital gains exemption. If we do it her way, we lower our monthly mortgage payment but lose the yearly rental income of $30,000. Our income is around $130,000. Any input?

Answer: Each homeowner can exclude up to $250,000 of home sale profits from capital gains taxes if they have owned and lived in a property as their primary residence for at least two of the previous five years. Married couples can exclude up to $500,000. This tax break can be used repeatedly.

The federal capital gains tax rate is currently 15% for most people, so the full $500,000 exemption could save a seller $75,000 in federal capital gains taxes. If your state or city has an income tax, you could save there as well. California, for example, doesn’t have a capital gains tax rate, so home sale profits would be subject to ordinary income tax rates of up to 13.3%.

The math is a little different when you move into a property you’ve previously rented out, said Mark Luscombe, principal analyst for Wolters Kluwer. Over the years, you’ve taken tax deductions for depreciation of your property. When you sell, the Internal Revenue Service wants some of that benefit back, something known as depreciation recapture.

When you sell a former rental property, some of the gain will be taxed as income, even if you’ve converted the home to personal use, Luscombe said. The maximum depreciation recapture rate is 25%.

A tax pro can help you figure out the likely tax bill. Any tax savings would be offset by the net result of a move, such as the lost rental income (minus the lower mortgage payments) and the substantial costs of selling, including real estate commissions and moving expenses.

It’s not clear if you’ve already remodeled your current home. If you haven’t, please think twice about an extensive remodel if you plan to sell, because you probably won’t get back the money you spend. Home improvement projects rarely return 100% of their cost. You’ll typically get a better return by decluttering, deep cleaning, sprucing up the yard or putting on a new coat of paint.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

Love remote work? Here are expert tips for how to negotiate a permanent work-from-anywhere arrangement with your boss.