Romesh Wadhwani: Building up, and giving away

At 74, the Indian-American entrepreneur and philanthropist wants to continue pursuing his passion of building tech companies, and giving back to society

Indian-American billionaire Romesh Wadhwani

Indian-American billionaire Romesh Wadhwani

Image: Timothy Archibald

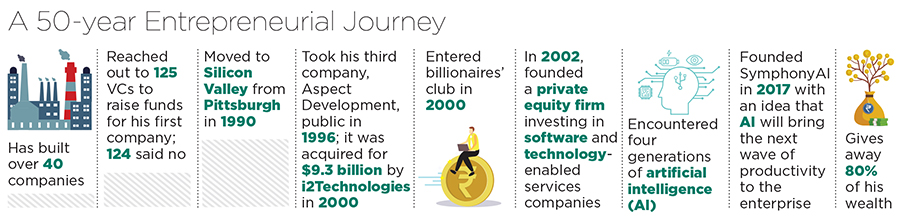

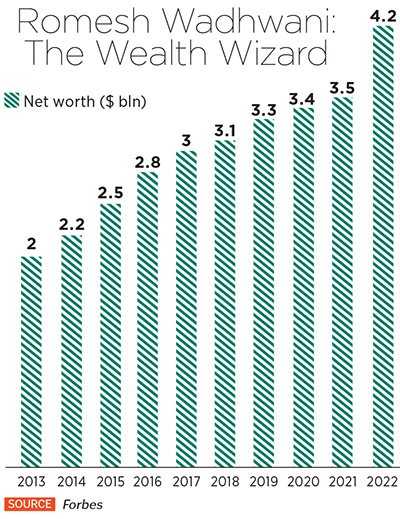

Romesh Wadhwani was born 10 days after India gained Independence in August 1947. He had to leave behind his place of birth, Karachi, now in Pakistan, during Partition, and arrive in Delhi as a refugee, where his family started life afresh. Wadhwani was diagnosed with polio when he was two, a condition he has had to deal with all his life. These challenges have made me even more resilient, says Wadhwani, who, at 74, is one of the world’s richest billionaires. The chairman of SymphonyAI, an enterprise artificial intelligence (AI) firm, and ConcertAI, an AI firm focussed on health care and life sciences, is now worth $4.2 billlion (₹32,000 crore), according to the 2022 Forbes World’s Billionaires List. Wadhwani, who is also the founder of private investment company SAIGroup, has built over 40 companies in his 50-year entrepreneurial journey.

Making his way to Silicon Valley

After obtaining a BTech degree from IIT-Bombay, Wadhwani decided to move to the US in August 1969 to pursue further studies. He arrived at Pittsburgh, Pennsylvania, with barely $2.5 (₹191 today). As an Indian immigrant, it took him a while to settle down in the new country, and he also faced hiccups while managing to secure a student loan. He then got a master’s—followed by a PhD—in electrical engineering from Carnegie Mellon University. During his PhD days, Wadhwani was clear about not working for any firm, and starting his own company instead. With no previous business or management experience, the then-25-year-old decided to take a leap of faith and set out on his entrepreneurial journey.In the 1970s when the energy crisis had just hit the US, the price of oil and gas was going up. Sensing an opportunity, Wadhwani founded his first company, the Compuguard Corporation, in 1972, to develop and commercialise software for energy management and security in commercial buildings.

There were many roadblocks along the way, but Wadhwani kept going. Raising money for the first company is something he will never forget. He reached out to 125 venture capital (VC) firms all over the US as he needed a capital of $100,000. The first 124 said ‘No’, but the last, Urban National Corp in Boston, agreed to fund the company. He ran Compuguard for 10 years and turned it into a $10-million business before selling it. Wadhwani was among the first few entrepreneurs in Pittsburgh to build high tech companies.

Next, he took over American Robot, a company that had been launched by the Rockefeller family. He raised over $40 million in venture capital while building it into a robotics technology leader.

When Japanese manufacturers started introducing their robots into the US market at lesser costs, Wadhwani’s company suffered heavy losses. But he felt a moral obligation toward the VCs who had invested in the company and he stuck with American Robot for 10 years to help them get back most of their money. He worked to transform the company into a computer integrated manufacturing software firm. “My first two companies were mediocre. I made so many mistakes... and, of course, I learnt a lot from them. But I was really frustrated because even after 20 years as an entrepreneur, building two companies, 10 years each, I did not feel that inner joy and satisfaction, or great feeling of success, compared to what I felt was happening in Silicon Valley,” recollects Wadhwani over a video call with Forbes India in April.

Entrepreneurs in Silicon Valley were innovating with personal computers (PCs), disk drives, semiconductors and more. This made Wadhwani realise that he was on the back foot. So he decided to take the tough call of leaving Pittsburgh and moving to Silicon Valley in California with his wife and four-year-old daughter, to build his third company. “It was a very difficult choice because we had lots of wonderful friends in Pittsburgh. But sometimes when you are driven to do something bigger than what you have done before, you have to make that kind of personal sacrifice. And this was the best move and best decision I ever made, because after coming to Silicon Valley, I was reborn as an entrepreneur,” recalls Wadhwani.

A year later, in 1991, he launched Aspect Development, a collaborative software solution for business-to- business market places. This company was a huge success. Starting out all over again with no network in a new state, however, was not easy. But Wadhwani was no stranger to starting afresh.

In 1996, when he decided to take this company public, it went through its ups and downs. “We missed the public quarter, saw a drastic crash in the stock price from $60 to $6 per share. There were many hiccups. Later, we revamped the company internally and came out with a whole bunch of new products,” he says. In 2000, the company got acquired for $9.3 billion by i2Technologies, making it the largest software acquisition at the time. The same year, Wadhwani also entered the billionaires’ club. In 2002, Wadhwani founded Symphony Technology Group (STG), a private equity firm investing in software and technology-enabled services companies. STG grew from a startup to having $2.5 billion in combined revenue as of 2012 .

“In the years that I have worked with Romesh, his incredibly high level of energy and drive have not changed. Maybe it’s even increased. I still get emails from him at midnight. He works all the time,” says Nigel Pratt, who has worked with Wadhwani since 1994, and is senior vice president of technology at Symphony RetailAI. “One memory that stands out is, years ago on vacation, he was on the beach working away, with a towel over his head covering out the glare so that he could use his laptop.”

Foray into AI

Wadhwani founded SymphonyAI in 2017 with the idea that AI will bring the next wave of productivity to the enterprise. Since then, the company has expanded to seven industries and dozens of AI software as a service (SaaS) applications. The California-based startup focuses on driving revenue growth and operational excellence for customers in vertical sectors, including retail, consumer packaged goods, defence and financial services.Wadhwani has seen probably five generations of AI. First was when he was at Carnegie Mellon University, and gained knowledge from Herbert Simon and Allen Newell, the early pioneers of AI, who happened to be his professors.

His next stint with AI was in 1981 with American Robot, where he wanted to develop a new industrial vision system that would use AI to tell you exactly where parts are placed, or what objects look like, say, in electronic or mechanical assemblies, and feed this information to the robot so that the robot could pick things up, place and assemble things.

They actually developed one of the world’s first AI-based industrial vision systems back in 1984-85. However, that product was not successful, because at that time, computer hardware was too clunky and slow. Plus, software operating systems were not fast enough to keep up with this real time information that was coming into the vision system.

His third brush with AI was when Wadhwani acquired a company called Techknowledge back in 1988-89. It was one of the first companies doing expert systems, which are essentially AI systems that mimicked the expertise of human beings.

Wadhwani claims these were among the best AI techniques available in the 1990s, which was called the AI winter as people had lost their faith in the possibilities of AI. But there were certain limitations. While the human brain is agile, flexible and constantly adapting to external and internal environments, hard-coded systems were rigid, inflexible, and not adaptable. Ultimately, his third attempt with AI also did not succeed.

During the turn of the century in the 2000s, several developments built a new foundation for AI, explains Wadhwani. Cloud computing was providing powerful underlying computing capabilities needed for advanced AI. “The whole idea of open source software made it easier for smart entrepreneurs to create individual tools or individual AI algorithms that could be connected together for a much bigger purpose. The world of software itself was changing. And lots of new tools and techniques and software development were coming to the forefront,” he says.

Within business enterprise, there was very little productive use of AI to transform and improve business operations. The fifth generation of AI was what Wadhwani saw as his opportunity to launch SymphonyAI. “I was looking at these first few waves of AI, all of them, fortunately, I had been connected with in some fashion, not commercially and not profitably. But at least I was aware of them. In 2017, I realised the next big wave is going to be in business enterprise. SymphonyAI is the culmination of that journey that started in 1969 when I first met Herbert and Allen at my university. Here I am, 50 years later, actually building a commercially successful group of AI companies, 50 years after first learning what AI was at that time. It feels like I am closing a circle,” he says.

Within business enterprise, there was very little productive use of AI to transform and improve business operations. The fifth generation of AI was what Wadhwani saw as his opportunity to launch SymphonyAI. “I was looking at these first few waves of AI, all of them, fortunately, I had been connected with in some fashion, not commercially and not profitably. But at least I was aware of them. In 2017, I realised the next big wave is going to be in business enterprise. SymphonyAI is the culmination of that journey that started in 1969 when I first met Herbert and Allen at my university. Here I am, 50 years later, actually building a commercially successful group of AI companies, 50 years after first learning what AI was at that time. It feels like I am closing a circle,” he says.The revenues of SymphonyAI reached $220 million last year (with ConcertAI adding another $130 million) and are expected to hit $300 million this year (with another $200 million for ConcertAI).

As part of a consideration for a potential future public offering, Wadhwani recently stepped down as CEO of SymphonyAI in favour of Sanjay Dhawan, who was CEO of publicly-traded automotive AI firm Cerence until last December. He has also previously worked for Wadhwani as CEO of Symphony Teleca, one of the Symphony Technology Group companies, until its sale to Harman for $830 million in 2015.

“Our main goal is to make SymphonyAI the leading enterprise AI company, with outstanding software that delivers real value. If we do that, and I think we are well on our way... we create the conditions where we could pursue a public offering. Whether and when we go public depends on several conditions, some macro and others under our control. We have the scale and financials to go for an IPO. However, our primary focus is to reach predictable growth metrics before we consider a public offering,” says Dhawan.

In 2018, Wadhwani and his younger brother Sunil, set up the Wadhwani Institute of Artificial Intelligence, an independent non-profit institute developing AI-based solutions for underserved communities in developing countries. The brothers funnelled in $30.7 million (₹200 crore) in India’s first AI research institute in Mumbai which was launched by Prime Minister Narendra Modi. It now has a team of more than 100 full-time AI researchers and other experts around the world working to address challenges such as tuberculosis, maternal and child health, and improving the incomes of smallholder farmers.

Giving back

Immediately after entering the world’s richest club, the Silicon Valley entrepreneur founded the Wadhwani Foundation in 2000, with the primary mission of accelerating economic development by driving job-creation through large-scale initiatives in entrepreneurship, small business growth, innovation and skilling. The initial focus was on India because Wadhwani felt that the US had a well-established culture of philanthropy with many philanthropists like Bill Gates, Warren Buffett and others, but the culture of large-scale philanthropy in India is still not as prevalent; plus job creation is of paramount importance there, he says.About six months ago, Wadhwani commissioned the Boston Consulting Group (BCG) to do a deep-dive analysis of every initiative in the foundation because he believes in absolute objectivity in making the right decisions and making sure the foundation is on the right track with its initiatives in India. BCG validated that the need for the entrepreneurship initiative is even stronger today than it was 20 years ago. It also came up with a number of recommendations on how the foundation can do it better.

Wadhwani believes that when you have been privileged and you receive a lot, you should give back and share. “It’s about the ability to apply the mindset of focusing on outcomes as a way of determining whether the philanthropy is achieving its goals or not, which is different in some cases from the way other philanthropy is around. We are very outcome- and scale-focussed, very technology centric, we use technology as a way of achieving scale. And we are doing this in each of our big initiatives.”

Today, his foundation is scaling impact in 20 countries across Asia, Africa, Latin America, and the US. It works in partnership with governments, non-profits, corporations, and educational institutes through initiatives like Wadhwani Advantage, which empower thousands of small- and medium-sized businesses with capabilities to maximise their growth potential; Wadhwani Entrepreneur, which educates and enables tens of thousands of startup entrepreneurs; Wadhwani National Entrepreneurship Network, which empowers professionals, post-college, college and pre-college students with knowledge and skills to create high-potential startups. There’s also the recent initiative Wadhwani Community College, which is a US-based initiaitve for enabling digital transformation of community colleges to skill and place one million students in jobs of the future.

Most billionaires in India donate less than one percent of their wealth, according to the India Philanthropy Report 2022 by Dasra and Bain & Company. The wealth disparity among people is high and is constantly growing. “In this case, Indian billionaires should just look in a mirror and find self-awareness. I’m giving away 80 percent of my wealth, I don’t have to, no one’s forcing me to. I’m doing it voluntarily. A significant part of that is going back to India. Why am I doing it? Simply because I feel it’s right. There are lots of people in India who need help. So if I’m willing to do it from the US, why aren’t they willing to do it from India?” says Wadhwani who was awarded Padma Shri by the government of India in 2020 in recognition of his services through the Wadhwani Foundation. “Giving my wealth away gives me great joy because I continue to feel the satisfaction of being an entrepreneur,” he says.

Previously, Wadhwani used to dedicate 95 percent of his time on building companies and five percent on philanthropy, then it became 90-10. Now, it is 75-25. And a few years from now, it’ll become 50-50, he says.

“Romesh’s level of drive is just amazing. He aims really high in everything he does, he works incredibly hard to achieve his goals, and he believes in himself,” says Sunil, who is also an entrepreneur, investor, and philanthropist. “He has faced obstacles at many points in his life, and has dealt with them with confidence and a firm belief in his ultimate ability to succeed.” Sunil also shares that he and Wadhwani both love music of all genres: Rock, jazz, blues, classical, Bollywood. “The difference is that Romesh enjoys listening and I play in a rock band—he’s clearly the smarter brother!”

(This story appears in the 06 May, 2022 issue of Forbes India. To visit our Archives, click here.)