Highlights

Oil and Gas Digital Transformation and the Workforce Survey 2020

1. Everyone agrees — digital is critical

Oil and gas executives recognize the value in digital technologies and anticipate significant investment in them. Despite a breadth of disruptive trends facing the industry, survey respondents believe increasing availability of data analytics and insights has the greatest potential to positively impact their business growth.

Executive survey

43%identified the increasing availability of big data analytics and insights as one of the top-three trends that will positively impact their company’s business growth in the next three years.

Executive survey

39%identified decarbonization and other changes in response to climate change as another of the top-three positive trends of the sector, as much a technological as a business challenge and a reminder that companies can position themselves to gain from decarbonization.

Executive survey

92%agree their organization will have to change the way it operates coming out of the current downturn.

We need to keep evolving as a company or we’re going to become obsolete. We have to innovate, we have to be up to date, we have to be current, we have to be ahead of it, or the company will be taken over by somebody else and it’ll cease to exist.

2. Being digital vs. doing digital

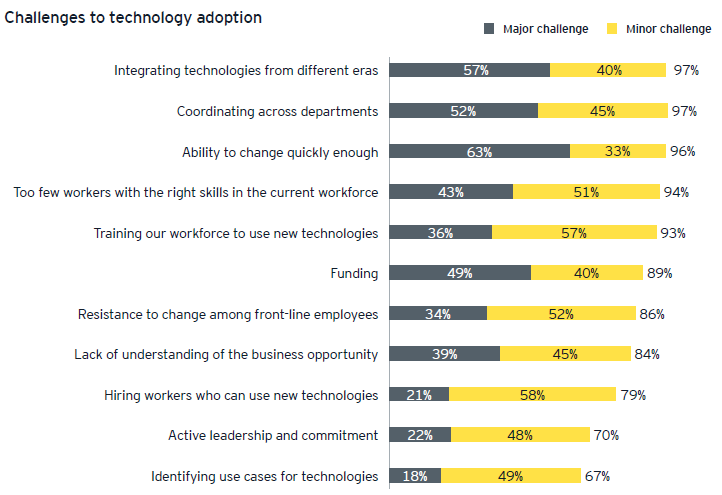

Many challenges to technology adoption are organizational and cultural — coordinating across departments, the ability to change in a timely manner, a lack of workers with the right skills and the challenge of training workers to use new technologies.

If you think about barriers, there are cultural barriers, there are technology barriers and then there are skills barriers. You can throw money at a problem and upskill your workforce. You can throw money at a problem and bring new technology in. Culture is a tougher nut to crack. The reality is, you can throw all of the money and resources you want at the other two but if you still have that cultural barrier blocking you, you’re going to fail.

3. The skills gap is real

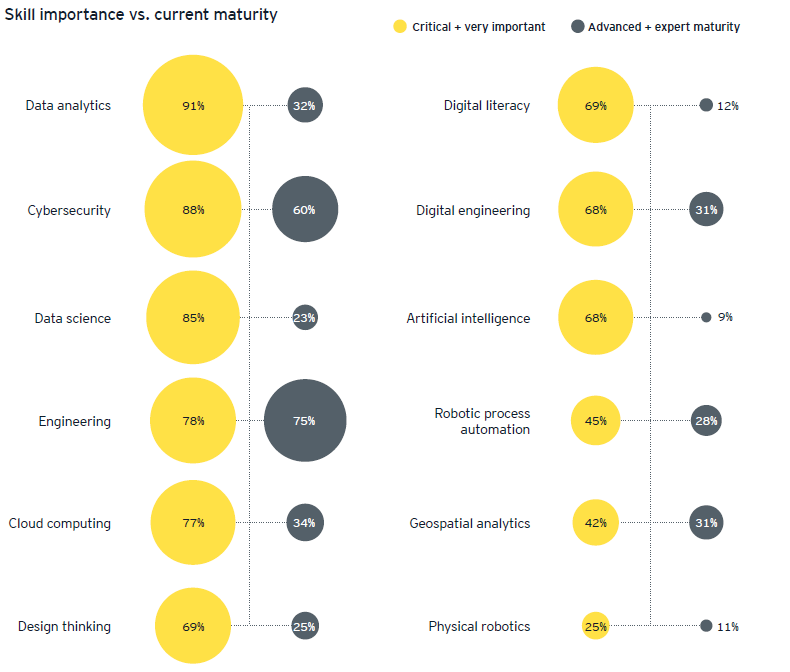

Among the technologies companies that currently use or are using planning to use, a significant percentage of executives say their company does not have the skills necessary to realize the technology’s investment value. Further, there is a substantial gap between the importance of specific skills and a company’s current maturity across the full range of digital technologies.

We can have the best technology, but if you don’t have the ability to connect the dots, to understand where the application of technology would create either better process efficiency that we’re trying to have, or create a totally new top line for the organization, or new business for the organization, none of that would happen.

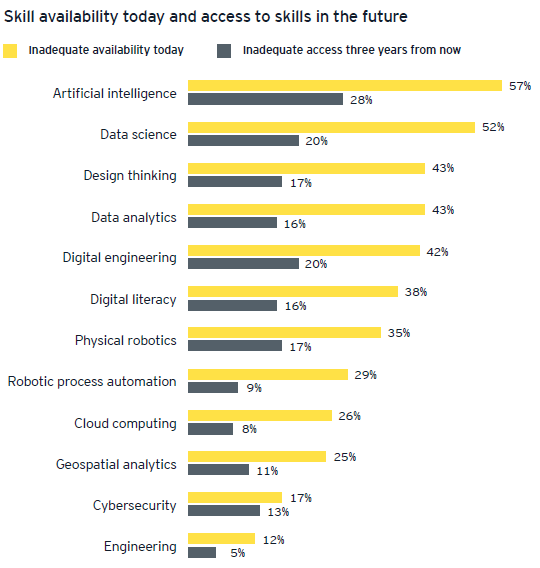

4. Competition for talent will heat up

Executives predict shortages of workers with digital skills will improve over the next three years, but this may be overly optimistic given the market demand for these skills across all industries. Further, even with increased availability, many still anticipate inadequate access to certain skills.

The greatest shortfall is on arguably the most important of digital technologies, artificial intelligence (AI), a critical and potentially game-changing technology given its role in taking advantage of big data. Without AI, it is doubtful companies can take full advantage of the sheer volume of data other digital technologies either generate or rely upon.

5. So what will companies do?

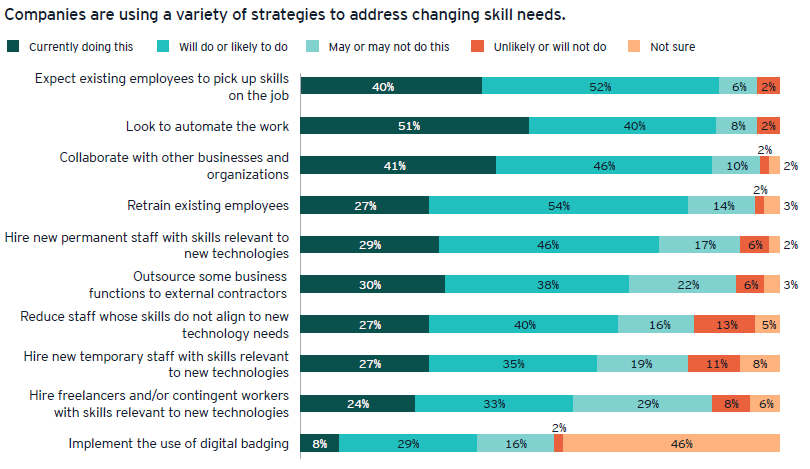

Despite the recognized importance of skills to their success and competitive advantage, most oil and gas executives report their companies do not have a robust plan to reskill their workforce. Instead, executives say their companies will deploy a smattering of strategies to account for these gaps.

For most companies, the approach to filling skills gaps is highly variable and fragmented. Companies need broad consensus on priority skills and a coherent, comprehensive approach to identify the skills they have, those they need now and those they will need in the future, and then address the gaps with measurable and interconnected strategies.

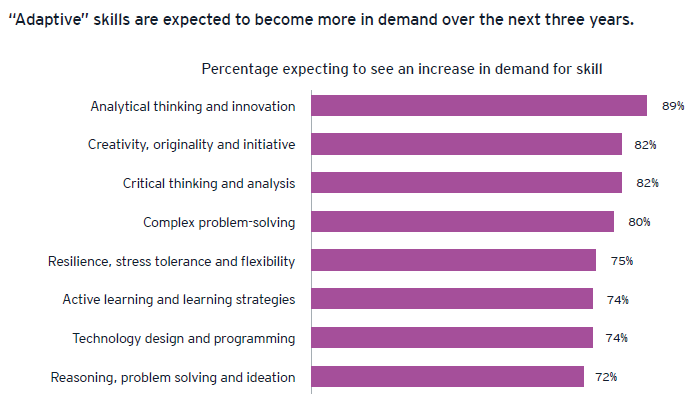

6. An influx of adaptive skills

The digital era will drive a reordering of priority skills in the workforce. Historically referred to as “soft skills,” these adaptive skills are critical to the behaviors and mindset necessary to have the flexibility, creativity and resilience to test and apply new technologies against industry problem sets. The challenge — these skills are in short supply and needed across all industries.

Effective adoption of digital technologies requires behavior, mindset and skill shifts. It is not enough for companies to have the technical expertise to make use of a technology. They must also have the skills to apply those technologies as broadly and strategically as possible — with critical thinking, creativity, innovation, problem solving, ideation, etc. — to find and extract every bit of value possible. This is the difference between doing digital and being digital.

With the pace of change of technology, you’re going to look for people who are able to adapt … if we’re making data more readily available to people, then you’re going to want people to have analytical skills who can draw conclusions from that data to make better decisions faster.

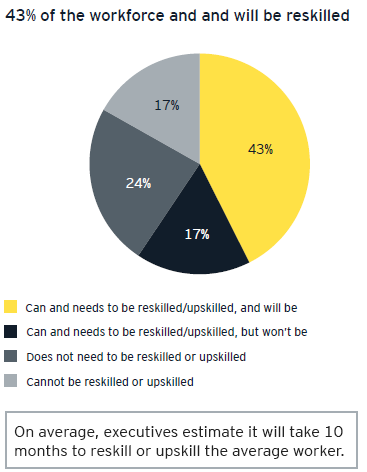

7. Reskilling is more than training, it requires change

Executives recognize the enormity of the reskilling challenge — they estimate nearly 60% of workers will need to be reskilled to maintain competitive advantage.

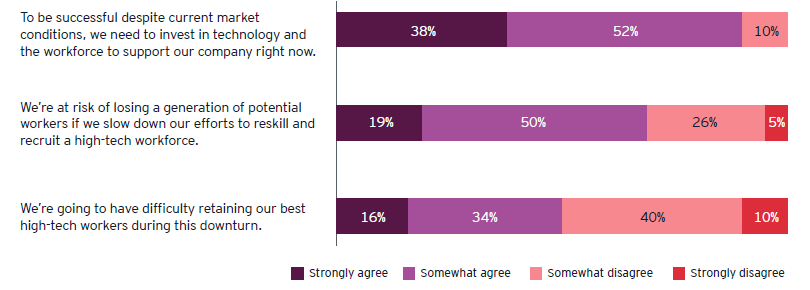

8. Investments in talent aren’t optional

The skill imbalance may be exacerbated by current market conditions as oil and gas budgets are slashed, workers are furloughed or laid off, and technology investments are viewed as optional. This is a reality likely to persist for several quarters.

Effective adoption of digital technologies requires behavior, mindset and skill shifts. It is not enough for companies to have the technical expertise to make use of a technology. They must also have the skills to apply those technologies as broadly and strategically as possible — with critical thinking, creativity, innovation, problem solving, ideation, etc. — to find and extract every bit of value possible. This is the difference between doing digital and being digital.

The right thing is to invest through the cycle or even better if you can invest countercyclically ... the next best thing to do is just have measured investment through the cycle and recognize that if prices rebound there’s going to be tremendous demand for talent and data analytics and data science experts and you’re going to have to pay dearly for that, just like you pay dearly for any other products during a boom.

9. A playbook for survival and success

Oil and gas companies are making significant investments in digital technology. But our survey shows many don’t have the workforce skills to realize the fullest return on those investments — or a plan to develop the adaptive and technical skills necessary to do so. To navigate the uncertainty and disruption brought by changing market conditions and COVID-19, companies will need to secure competitive advantage through a well-skilled workforce capable of delivering digital transformation.

EY insight:

Data and analytics are key to driving efficiency across the value chain. As an example, our estimates show an oil and gas company could potentially unlock more than US$145 million of value annually by integrating its key processes across the upstream oil and gas value chain with a common data model. However, without skilled and trained workforces to operationalize around a common data model or to fully integrate processes across the organization, oil and gas companies will continue to leave money on the table.

Contacts

Lance Mortlock

EY Canada Strategy Partner and Oil and Gas Leader

lance.mortlock@ca.ey.com

403 206 5277

Robert Alexander

Associate Partner, People Advisory Services

robert.alexander@ca.ey.com

403 206 5195

Shane Monte

Partner, People Advisory Services

shane.monte@ca.ey.com

403 206 5391

Christopher Rush

Partner, People Advisory Services

christopher.rush@ca.ey.com

403 206 5191

Roxanne Israel

Partner, People Advisory Services

roxanne.n.israel@ca.ey.com

403 206 508

Learn more at ey.com/digitalskills

To help oil and gas companies unlock value in these difficult times, EY has teamed with Microsoft to build a scalable, cloud-based accelerator application known as the EY Digital Energy Enablement Platform, or EY DEEP. EY DEEP helps integrate key processes across the upstream oil and gas value chain with a common data model to allow full extension of the platform across the organization. This extension breaks down silos to integrate reservoir engineering to production planning, well operations to supply chain management, and land management to decommissioning; supports better decision-making; improves efficiency; and reduces time and cost. Read more about the EY DEEP platform at https://www.ey.com/en_us/oil-gas/ey-deep-digital-energy-enablement-platform.

To help companies upskill employees for the future world of work, EY has developed the Adaptive Skills Accelerator — a development program that combines a rigorous capability assessment and a custom learner journey connected to a portfolio of EY and curated content that is all supplied through an EY-developed Learning Experience Platform. The application contributes to both organizations and their employees and establishes the foundations for success in the workplace of the future. Read more at: https://www.ey.com/en_gl/workforce/culture-talent-leadership.

Contact us

Summary

To what extent does your company have a plan around not just the technical side of work but also the skills side? Getting the most out of your technology investments requires maximizing the value of your people. A human-centered approach pays off when you need it most: now and in the future.