New York, London, Copenhagen, Singapore 23 August 2022.

Denominator today announces a new partnership with FINBOURNE Technology, a SaaS investment data management provider. The partnership aims to closely support the global Buy Side, as it responds to increasing demands for DEI transparency, amid a new generation of value-based investors.

The integration of Denominator’s unique data set is a timely addition to FINBOURNE’s flagship investment management platform, LUSID, following an announcement from the Principles for Responsible Investment (PRI) earlier this year. The UN-supported network of institutional investors, with a combined AuM of $130 trillion, has called on signatories to enforce DEI reporting across investment holdings and the supply chain, and is expected to trigger increased scrutiny from regulatory bodies worldwide.

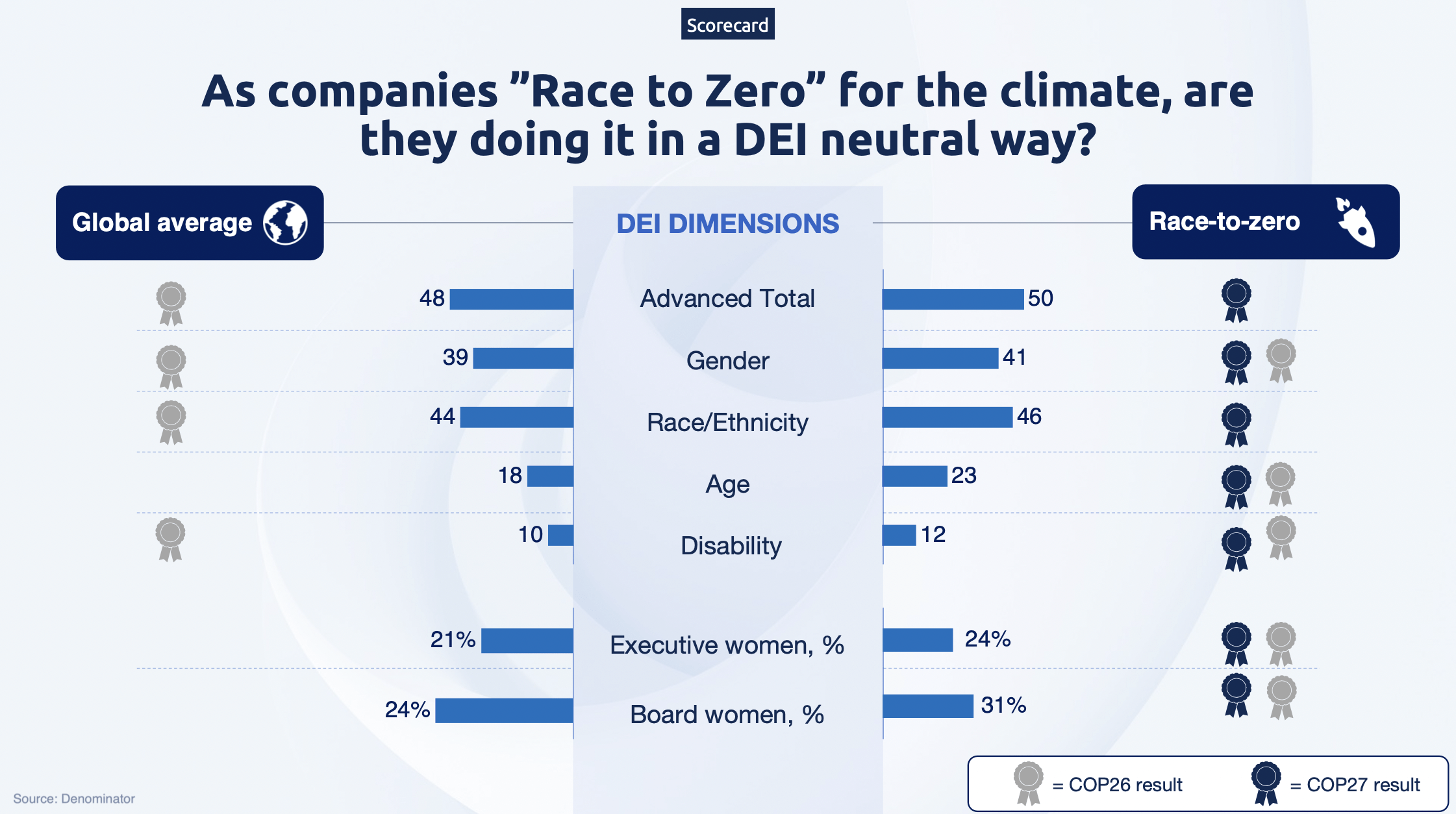

The combination of heightened investor and regulatory expectations, including the more recent DEI policy consultation from the UK Financial Conduct Authority (FCA)*, is escalating the Buy Side’s need for holistic and granular insight into the DEI performance of portfolio companies. Given the number of aggregated ESG ratings and methodologies in the market, the, detailed analysis and interpretation of DEI data has now become a complex and heavily manual task for many asset managers, often leading to a narrow focus on Gender at board level.

FINBOURNE and Denominator are seeking to turn this challenge into an investment opportunity, to drive fact-based decisions, improve transparency and accountability to end-investors, and ultimately close the global DEI gap through positive engagement.

Creating an investable universe using the largest range of DEI metrics in the market

Through the integration, FINBOURNE’s clients can seamlessly access Denominator’s data set with DEI data and scores across 15,000+ public companies and more than 1.5 million private companies. Built on internationally recognized frameworks, including the UN Global Compact’s Sustainable Development Goals and World Economic Forum’s Gender Parity, Denominator offers the most comprehensive data set of its kind.

With 250+ unique DEI variables across 15+ dimensions (gender, race, age, nationality, education, sexuality, disability, health…) asset managers can create and manage an informed investable universe, with the added ability to score and forecast portfolios. This includes not only popular variables e.g. % of women and ethnic minority board members and executive-level employees, but also more unique metrics, such as cognitive diversity e.g., the diversity of education across board members and senior management.

Enhancing trust and transparency for end-investors

Integrating DEI data directly into investment operations assures asset managers and end-investors that funds are accurately monitored and reported, based on mandated outcomes. This also enables progress to be tracked over time, in a specific attribute or the whole portfolio, to make more informed investment decisions and report both internally and externally. Furthermore, firms can view raw data as well as final scores, choosing between Denominator’s proprietary logic, or adding their own methodology to create their ‘secret sauce’.

Delivering competitive investment strategies and products

The partnership aims to broaden the DEI footprint across the global investment community, to help support current data challenges and importantly advocate the investment opportunities that can be gleaned from Denominator’s diverse data set. Leveraging new and competitive capabilities, asset managers can launch new ESG funds and products with a DEI-specific mandate and reach untapped markets, such as the recent phenomenon of female investment platforms.

Anders Rodenberg, CEO of Denominator comments: “We are truly excited about this partnership with FINBOURNE Technology. The integration of our exhaustive Diversity, Equity, & Inclusion data will enable the global Buy Side to harness new and customized investment strategies that will appeal to investors and deliver competitive edge. As with the E in ESG, we aim to move the dial for this critical social element of ESG, from negative screening and best-endeavour reporting, to driving positive engagement with global companies and making DEI an active priority for global business and society”.

Matthew Luff, Head of Partnerships at FINBOURNE Technology adds: “Partnering with Denominator empowers our clients with quality data to create and manage an exciting new range of portfolios, catering to previously underserved sections of the population. Unlike measures such as emissions which are harder to conceptualize, we are all able to look around our workplaces and see diversity, or a lack of it. Our close partnership with Denominator delivers our clients actionable data and insights, to invest in those companies that are making strong returns, alongside a real commitment to DEI values.”

-ENDS-

For further information please contact

Emma Helbo, Content Manager, Denominator, or

Mittal Shah, Head of External Communications, FINBOURNE Technology

About FINBOURNE Technology

FINBOURNE Technology was founded in December 2016 with a mission to reduce the cost of investing and increase transparency. In five years, we have grown from seven founders to over 150 employees, with entities in North America and Asia-Pacific. Leveraging SaaS technology and a secure cloud infrastructure, our solutions LUSID®, LUSID PMS™ and Luminesce® are designed to liberate, simplify and connect data, empowering everyone from emerging hedge funds to established global institutions. Delivering an interoperable Modern Financial Data Stack, we provide cutting-edge infrastructure that sits at the heart of the global investment industry. FINBOURNE is trusted by some of the world’s leading financial services firms, including Fidelity International, Baillie Gifford and Railpen. www.finbourne.com

About Denominator

Denominator provides fact-based data and standards to Diversity, Equity, & Inclusion (DEI) across organizations, industries, and countries. We do this to enable a more balanced world for growth and improved human interaction. We cover more than 1.5 million public and private companies, 85+ industries, and 190+ countries on 650+ DEI specific data variables. The data and analytical insights drive the most comprehensive DEI rating models and indexes, creating the global standard for measuring DEI performance. www.denominator.one

Notes to Editor

*In July 2022, The Financial conduct Authority (FCA) explored the impact of DEI in UK Financial Services, setting out its thoughts in a discussion paper published jointly with the Prudential Regulation Authority (PRA) and the Bank of England. It is expected to publish a Consultation Paper on this topic this summer 2022, followed by a Policy Statement, which will set out any new rules, requirements and guidance for UK financial services.