Pro-AV Business Index

Bounce Back! March Strong Again After Disappointing February

Highlights

- Pro AV is back on track. February delivered surprising disappointment after a solid start to the year, with the AV Sales Index (AVI-S) falling from 60.7 in January down to 53.4. Now we’re all the way back and even beyond, with the March AVI-S at 61.8. Given the lack of clear causation, we suspected and certainly hoped for a quick rebound. It’s a pleasure to see it happen. Commenters cited a number of factors affecting their business in the period, with uncertainty chief among them. In some ways, uncertainty was positive in that it’s reducing: Companies are settling into post-COVID work models, which is releasing funds (relatedly, the most recent Macroeconomic Trends Analysis (META) report covers new office norms; see the page here). In other ways, uncertainty was a negative, with fluctuating revenues straining businesses. One interesting comment identified supply problems as their top concern, but in a totally different way than it has been for the past three years: They’re finally getting stuff in after long delays, and so much so that they’re running out of storage space!

- Milestone alert: The U.S. employment report showed a heartening milestone in March: the Leisure and Hospitality sector has now recovered its pre-pandemic job levels. Given the rise of factors such as QR-code ordering, no-contact check-in, etc., recovering back to the 2020 level is a strong signal of how “back” this sector is. The recovery and growth align with the restoration of a broad trend we’ve tracked for years as it relates to pro AV: the rise of the experience economy. This story was very much disrupted by COVID-19, but our research shows it coming back. For example, AVIXA’s Industry Outlook and Trends Analysis (IOTA) report shows live events leading pro AV revenue growth right now (see here for more). We expect the experience economy to continue robust growth for the foreseeable future.

- There’s good news on employment too. The AVI-E (AV Employment Index) hadn’t suffered as dramatic a drop as the AVI-S, and it hasn’t recovered quite as strongly. But positive news here. is welcome just the same. For the AVI-E, the course was 57.1, 53.8, then 56.6 for January, February, and now March. In the wider economy, the U.S. employment report delivered more good news. Payrolls added 303,000 jobs, comfortably above expectations, and wages increased at an annual rate of 4.1%. These datapoints confirm a strong and healthy economy, which positions pro AV for a solid year in 2024.

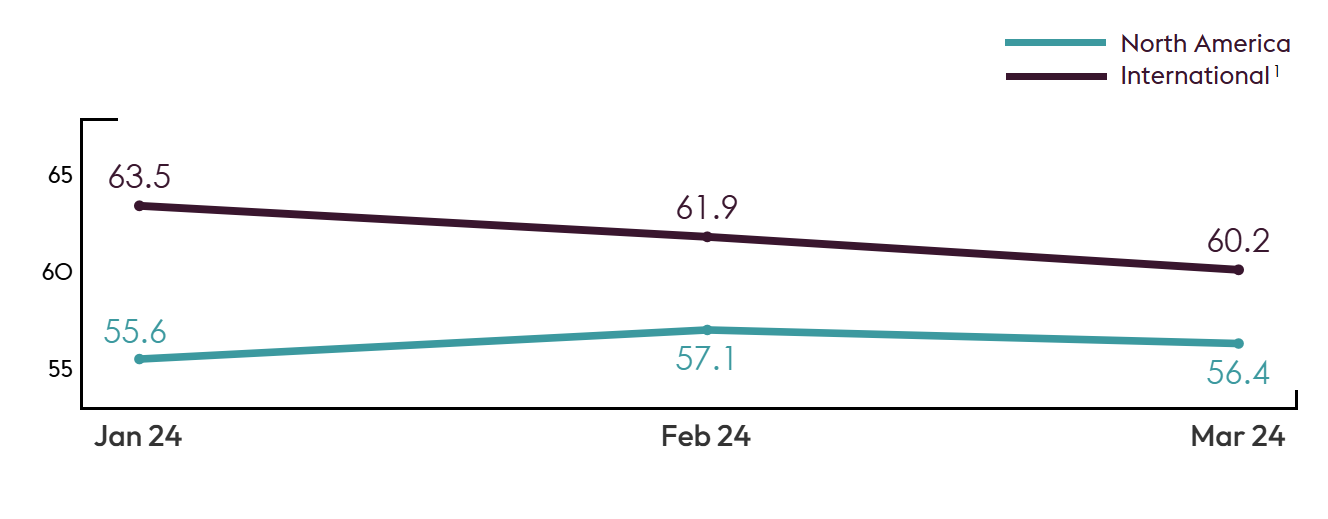

International Outlook

The regional outlook is presented as a three-month moving average to account for the smaller sample sizes, smoothing out movement from randomness. This can create odd effects, especially when there is a single-month outlier. The odd result is that March—our bounce-back month—reads as lower for March than it did for February. Rather than the monthly change, the more reliable information right now is the long-term trend, which shows convergence between the Rest of the World and the U.S. It was surprising how far the Rest of the World had led the U.S. in growth, so it’s been unsurprising to see the gap close. That said, we could easily see the gap expand again next month.

1Due to the small sample, the North American and International indexes are based on a 3-month moving average. March 2024 index is preliminary, based on the average of February and March 2024 and will be final with April 2024 data in the next report.

1AVIXA®, the Audiovisual and Integrated Experience Association, has published the monthly Pro AV Business Index since September 2016, gauging sales and employment indicators for the pro AV industry. The index is calculated from a monthly survey that tracks trends. Two diffusion indexes are created using the survey: the AV Sales Index (AVI-S) and AV Employment Index (AVI-E). The diffusion indexes are calculated based on the positive response frequency from those who indicated their business had a 5% or more increase in billings/sales from the prior month plus half of the neutral response. An index of 50 indicates firms saw no increase or decline in business activity; more than 50 indicates an increase, while less than 50 indicates a decrease.

Despite our company resilience, in general, the ELV-AV market in [region] is not stable, particularly during Q3 & Q4 of 2023, and the beginning of 2024 has significantly influenced our business operation. While we have maintained stability internally, external factors have presented notable challenges that warrant attention and strategic adaptation.

AV Integrator, Middle East/Africa

We are nine months into a merger with [company], and we are just starting to move out of the [city]-centric market and more into a national presence. We expect activity to pick up significantly in the next few months.

AV Provider, North America

The projects we have worked on for several months and some even for years were finally closed in the last quarter of 2023 and the beginning of 2024. In some cases, our customers were uncertain about the technological needs for new spaces; in others, like government projects, political issues were holding them.

AV Provider, North America

Single greatest factor impacting our organization is supply chain issues and storage space due to product finally arriving on site after waiting up to 18 months for some ordered items.

End User, North America

Methodology

The survey behind the AVIXA Pro AV Business Index was fielded to 2,000 members of the AVIXA Insights Community as well as many members of the ISE mailing list between March 27, 2024, and April 8, 2024. A total of 300 AV professionals completed the survey. Only respondents who are service providers and said they were “moderately” to “extremely” familiar with their company’s business conditions were factored in index calculations. The AV Sales and AV Employment Indexes are computed as diffusion indexes. The monthly score is calculated as the percentage of firms reporting a significant increase plus half the percentage of firms reporting no change. Comparisons are always made to the previous month. Diffusion indexes, typically centered at a score of 50, are used frequently to measure change in economic activity. If an equal share of firms reports an increase as reports a decrease, the score for that month will be 50. A score higher than 50 indicates that firms, in the aggregate, are reporting an increase in activity that month compared to the previous month. In contrast, a score lower than 50 is a decrease in activity.

About the AVIXA Insights Community

The AVIXA AV Intelligence Panel (AVIP) is now part of AVIXA’s Insights Community, a research group of industry volunteers willing to share their insights on a regular basis to create actionable information. Members of the community are asked to participate in a short, two-to-three-minute monthly survey designed to gauge business sentiment and trends in the AV industry. Community members will also have the opportunity to participate in discussions, polls and surveys.

Community members will be eligible to:

- Earn points toward online gift cards

- Receive free copies of selected market research

- Engage directly with AVIXA's market intelligence team to help guide research

- Ask and answer other industry professionals' questions

The Insights Community is designed to be a global group, representative of the entire commercial AV value chain. AVIXA invites AV integrators, consultants, manufacturers, distributors, resellers, live events professionals, and AV technology managers to get involved. If you would like to join the community, enjoy benefits, and share your insights with the AV industry, please apply here