Inflation Reduction Act Leaves Farmers and Traditional Conservation Programs Behind

Key Takeaways

- Farm-related conservation resources in the Inflation Reduction Act (IRA) are unlikely to benefit all farmers as a recent review of the Environmental Quality Incentives Program and the Conservation Stewardship Program financial obligations revealed that fewer than half of the currently funded projects would meet the climate-smart requirements for IRA eligibility.

- The IRA exclusively prioritizes certain greenhouse gas-reducing and carbon-sequestering activities, ignoring the needs and requests for increased investments in locally led conservation, natural resource, and wildlife habitat activities desired by farmers and ranchers in the upcoming farm bill.

- By moving IRA resources into the 2023 farm bill and broadening the eligibility criteria to include other resource needs that reflect local demand, Congress can create permanent baseline and provide additional resources to address the conservation needs of all farmers and ranchers -- including but not limited to climate-smart agriculture and forestry activities.

The Inflation Reduction Act of 2022 (IRA) appropriated more than $18 billion in new funding specifically for climate-smart agriculture and forestry (CSAF) greenhouse-gas-mitigating and carbon sequestration activities into existing U.S. Department of Agriculture (USDA) conservation-related programs including the Environmental Quality Incentives Program (EQIP), the Conservation Stewardship Program (CSP), the Agricultural Conservation Easement Program, and the Regional Conservation Partnership Program (RCPP). However, the law dictates that no projects or funding can extend beyond September 30, 2031. This conservation fiscal cliff is the catalyst for efforts to move IRA resources into the farm bill and create permanent baseline.

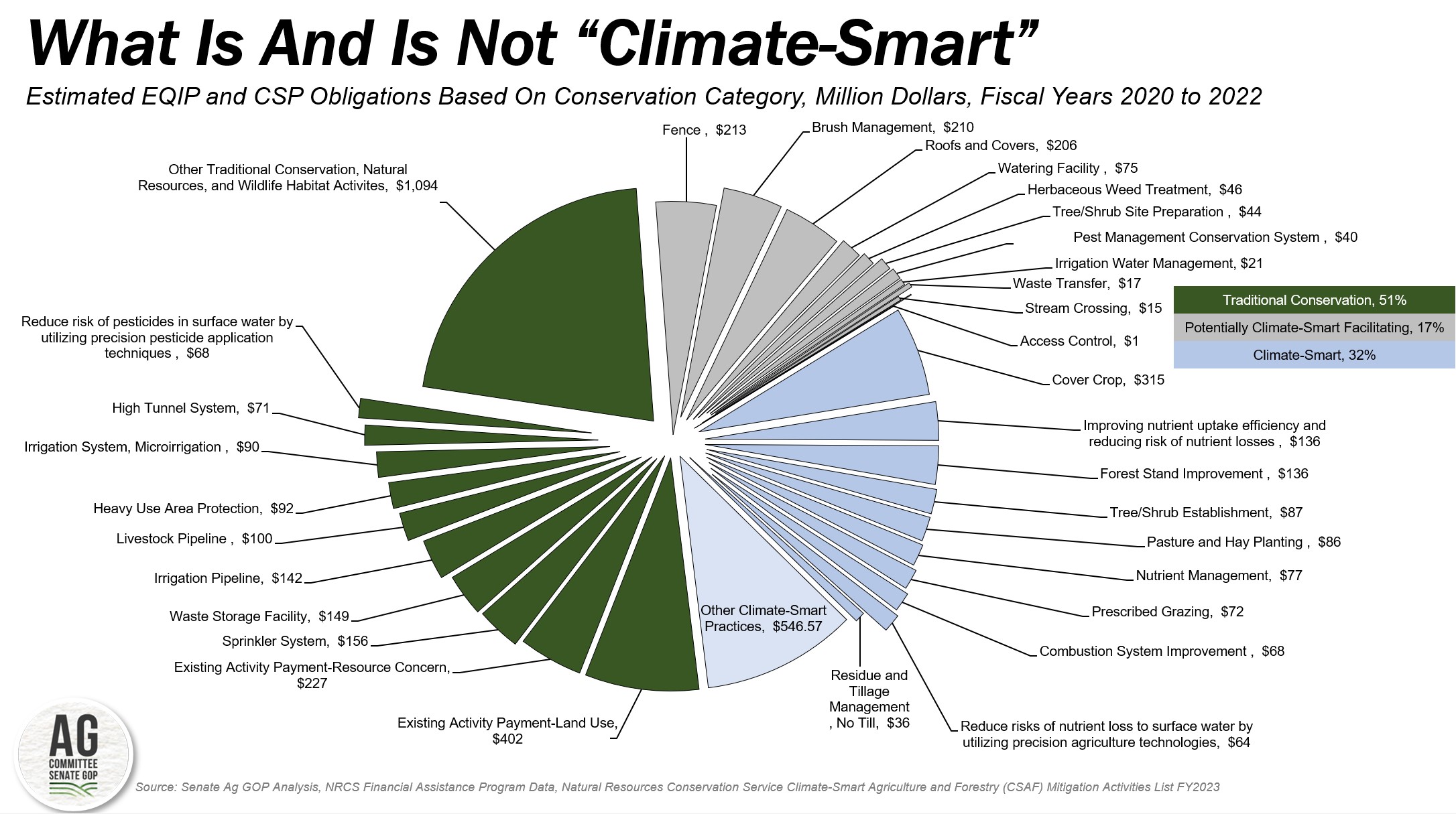

The list of practices eligible for financial and technical assistance from the IRA was not directed in statute. Late last year, USDA administratively determined the specific practices that quantifiably facilitate the management of climate-smart agriculture and forestry goals (Climate-Smart Agriculture and Forestry (CSAF) Mitigation Activities List FY2023). Examples of CSAF activities include cover crops, tree and shrub establishment, prescribed grazing, reduced till, and no-till, among others. Other activities that help to facilitate CSAF activities but that do not have quantifiable benefits, or do not have any mitigating effects on their own, may potentially be funded as well.

While identifying existing practices that are determined to be climate-smart, USDA also confirmed that hundreds of existing conservation, natural resource, and wildlife habitat practices currently requested by producers are not considered climate-smart “enough”, and as a result, would be ineligible for additional financial or technical assistance under the IRA.

This list includes prescribed fire and brush management to preserve grassland ecosystems, irrigation efficiency practices that save groundwater and surface water to mitigate the effects of climate variability, terraces that help improve water quality by reducing nutrient runoff, and manure management practices that help with environmental regulatory compliance. These practices have long been considered climate-friendly and help achieve a producer’s conservation and sustainability goals, but now they are not deemed climate-smart and thus cannot qualify for these IRA dollars.

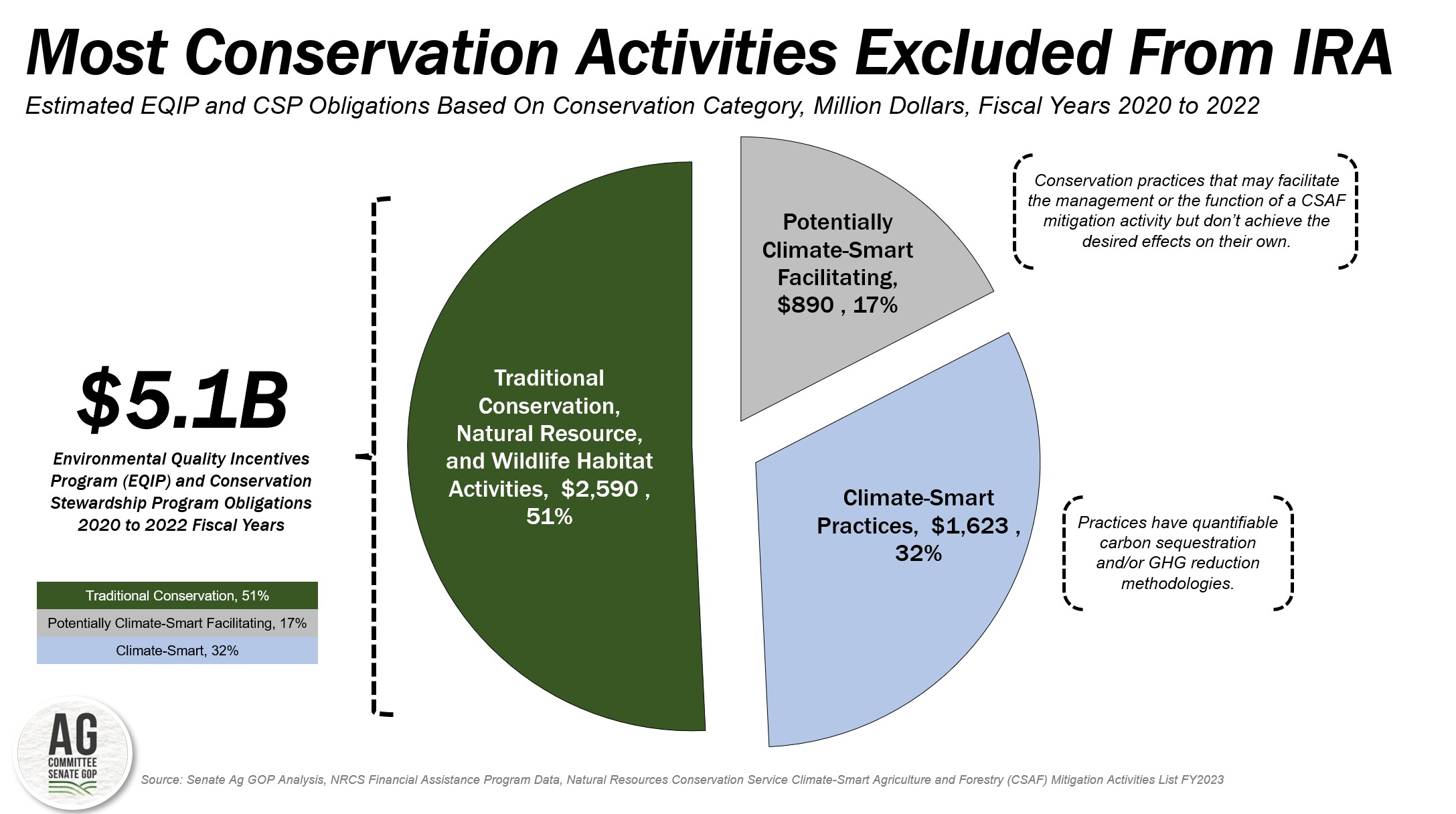

Those traditional conservation program activities that were excluded from the IRA represent a sizable share of total conservation program benefits consistently requested by farmers, ranchers, and foresters to meet their local resource needs. Estimates based on data from USDA’s NRCS Financial Assistance Program Data Download on EQIP and CSP – the two largest working lands conservation programs – reveal that from 2020 to 2022, a majority of the EQIP and CSP projects that were funded -- 51% or nearly $2.6 billion of the $5.1 billion in obligations -- are not considered climate-smart as determined solely by USDA. That is a conservative estimate that could be higher given that 17% of funded practices may or may not qualify directly as a climate-smart activity.

Based on those estimates, it’s clear that most of the practices farmers and ranchers are implementing to meet their conservation or sustainability goals will not be supported by the IRA. Instead, the IRA favors of a one-size-fits-all approach over the local conservation, natural-resource-conserving, and wildlife habitat needs of agriculture and rural America.

As evidenced by the testimony of witnesses in both full committee and subcommittee hearings, farmers and ranchers value the farm bill conservation programs which have long addressed broad climate and environmental concerns. Many of those traditional conservation practices that are so important to America’s producers are left behind in the IRA.

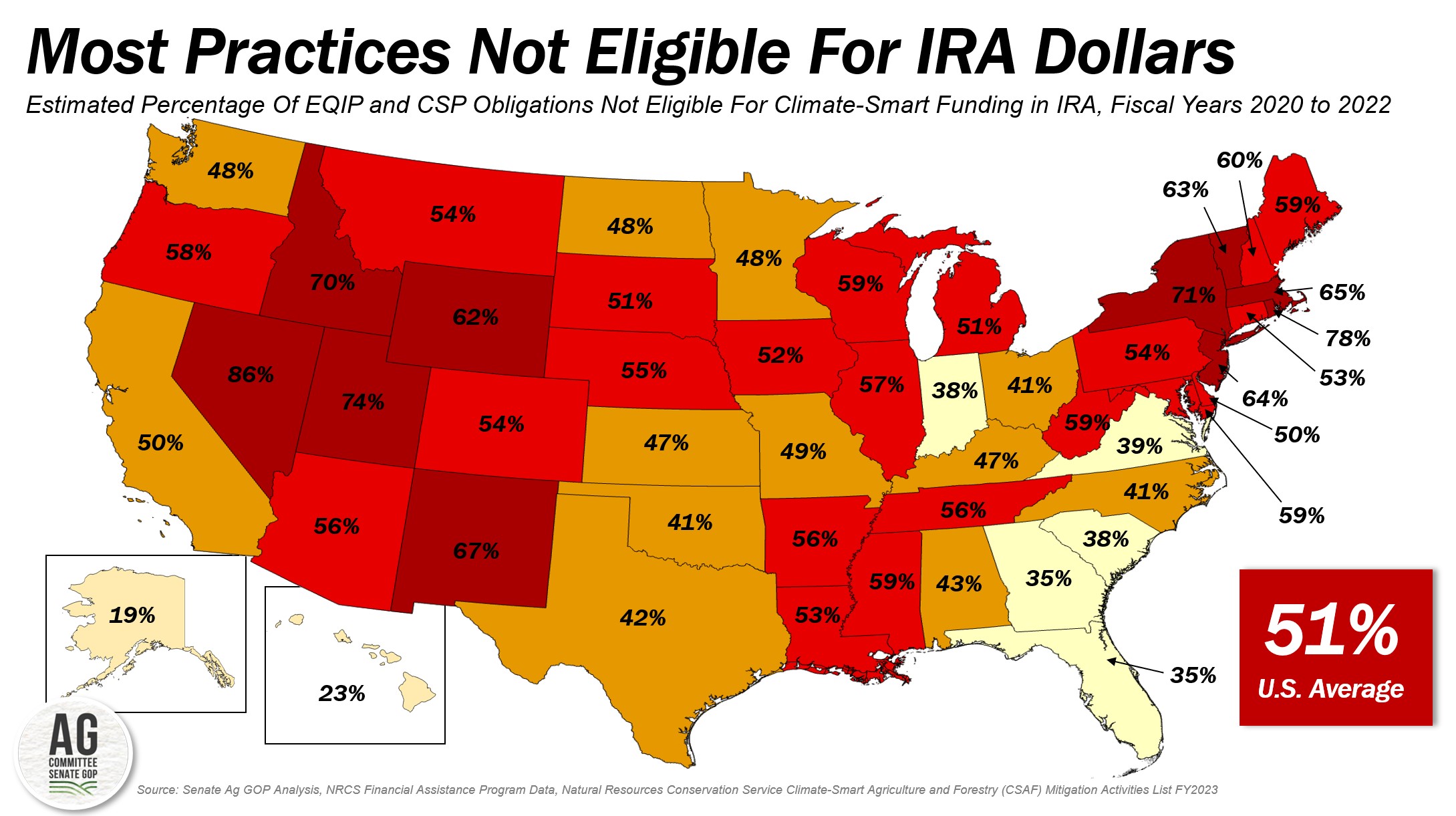

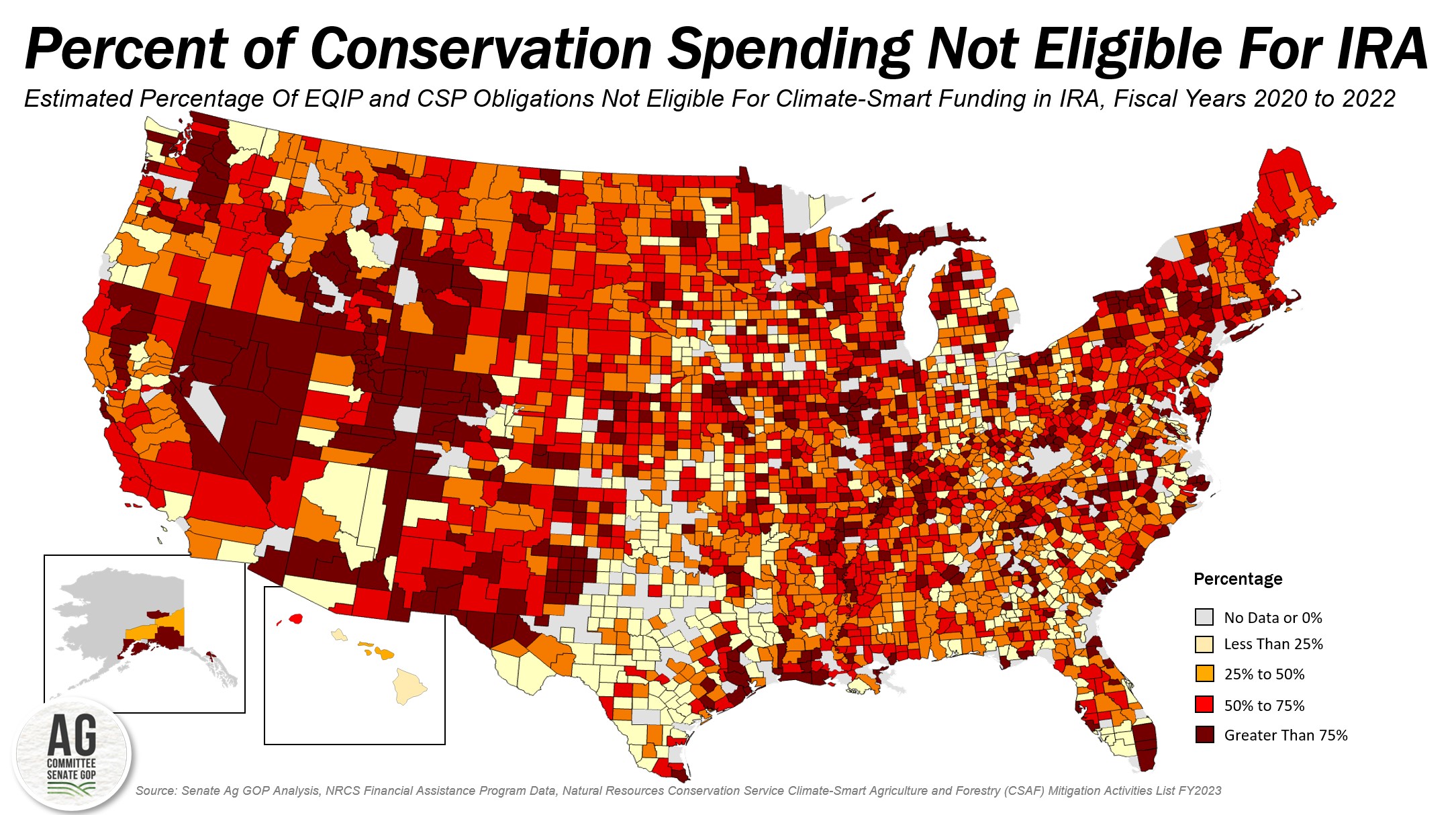

For more insight, USDA’s NRCS program data also includes conservation obligations by practice at the state and county levels. $5.1 billion in conservation outlays in the EQIP and CSP program from 2020 to 2022, across the U.S., more than 50% of the conservation funding in 34 states fails to meet USDA’s climate-smart thresholds based on that data.

As an example, in New York, the largest EQIP-funded practice in 2022 was waste storage facilities commonly used by dairy farms to manage manure as part of a nutrient management plan as required by state law. Despite the benefits they provide in managing manure and preserving water and soil quality, those projects will not be eligible for IRA funding. State-wide over 70% of dollars requested and funded by New York producers — one of the largest milk-producing states in the country — would not be eligible for IRA resources. Similarly, in Idaho, Nevada, Rhode Island, and Utah more than 70% of the various conservation practice funding favored by producers would be ineligible for IRA funding.

Conclusion

The Inflation Reduction Act provided more than $18 billion in new financial resources through farm bill-authorized conservation programs. Because the IRA climate-smart budget authority expires in 2031, there is an effort to move IRA resources into the 2023 farm bill to create additional permanent baseline for these programs and avoid this fiscal cliff.

However, due to the IRA’s prioritization of greenhouse gas-reducing or carbon-sequestering activities, if moved to the farm bill without broadening the eligibility to include other conservation needs, IRA financial resources would be unable to address the long list of other critical and bipartisan resource needs demanded by farmers, ranchers, foresters, and agricultural stakeholders in the farm bill.

Climate mitigation is a laudable goal, and U.S. agriculture represents approximately 10% of U.S. greenhouse gas emissions. However, moving and then expanding IRA conservation dollars in the farm bill to address other resource concerns can help farmers and ranchers not only adopt practices on the farm that sequester carbon and reduce emissions, but the financial and technical assistance can help with regulatory compliance associated with Waters of the United States, Endangered Species Act, or the Clean Water Act among others.