Click here to download the full report

More than 1,000 chain stores across New York City—or a little less than one out of every seven chains that were open this time last year—have closed their doors over the past twelve months, underscoring the immense difficulties facing retail businesses large and small during the pandemic. Overall, the number of chain stores in New York City declined by 12.8 percent—with 1.7 percent closing temporarily and 11.1 percent not indicating whether the closures are permanent or temporary. This is by far the largest year-over-year decline in chain stores since the Center for an Urban Future began our annual analysis of the city’s national retailers thirteen years ago, eclipsing last year’s 3.7 percent drop and the 0.3 percent decline in 2018.

Our thirteenth annual analysis of national retailer locations in New York City, which is based on data from store locators compiled between November 16 and December 5, 2020, shows that the 319 retailers listed in last year’s ranking reduced their total footprint by 1,021 store locations (including 886 closures and 135 temporary closures). The number of chain stores declined from a total of 7,948 stores in 2019 to 6,927 stores in 2020—a 12.8 percent decrease.

While every borough experienced notable declines in chain stores, Manhattan had the biggest losses, with the number of chain store locations in the borough shrinking by 17.4 percent (of which 2.2 percent were closed temporarily). In fact, Manhattan accounted for more than half of all chain store closures (518 out of 1,021) citywide. Brooklyn had the second-largest decline (decreasing by 12.3 percent, with 2.4 of those temporarily shuttered), followed by Queens (down 9.4 percent, with 0.6 percent temporarily closed), the Bronx (declining by 8.7 percent, including 1.4 percent temporarily closed), and Staten Island (down by 7.6 percent, with 0.7 percent temporarily closed). This is the second consecutive year in which all five boroughs have registered declines, but it is the first year in for any borough to see a decline of more than 10 percent. Last year, the sharpest drop was a 4.9 percent decline in Queens (-91 stores).

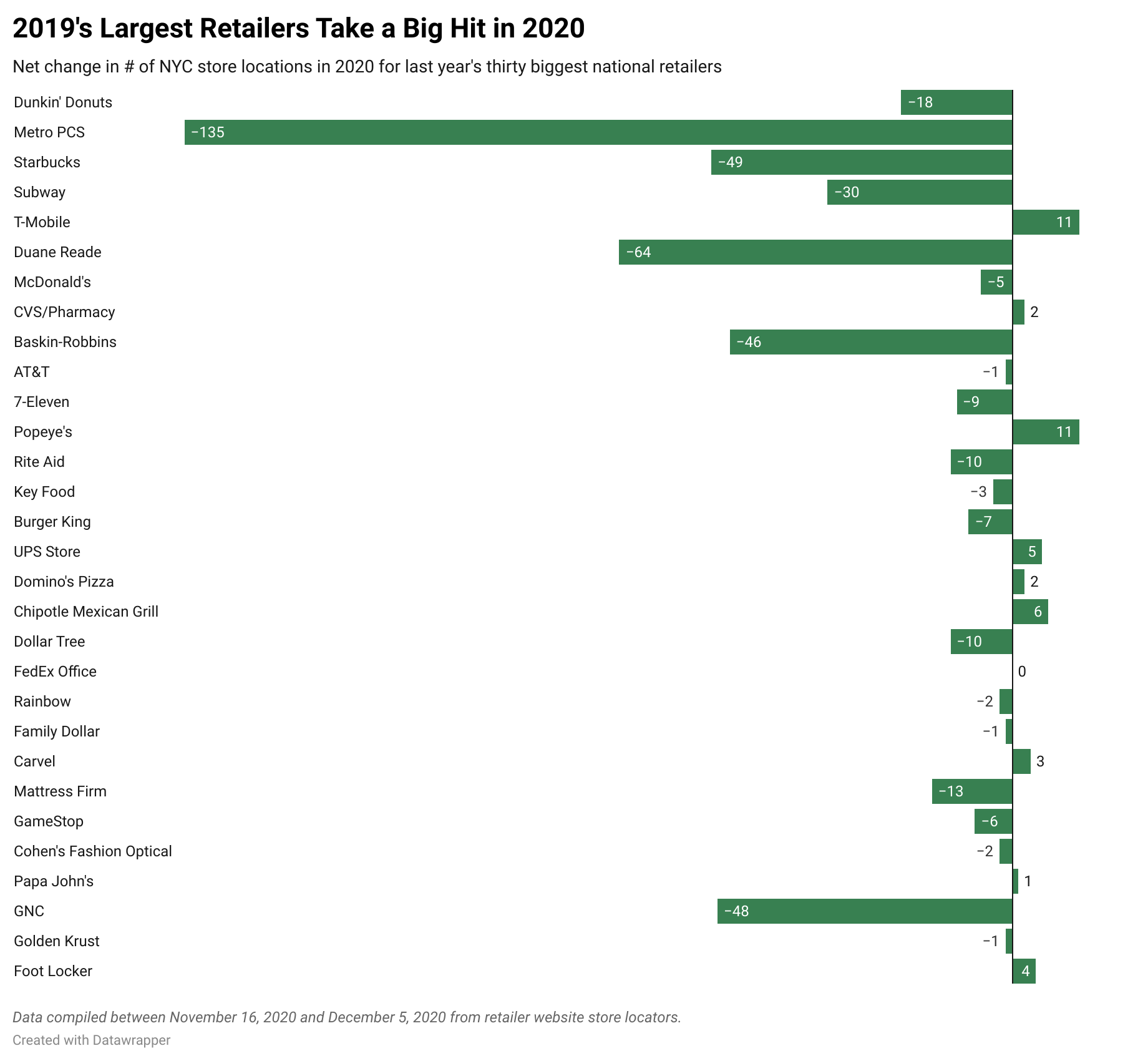

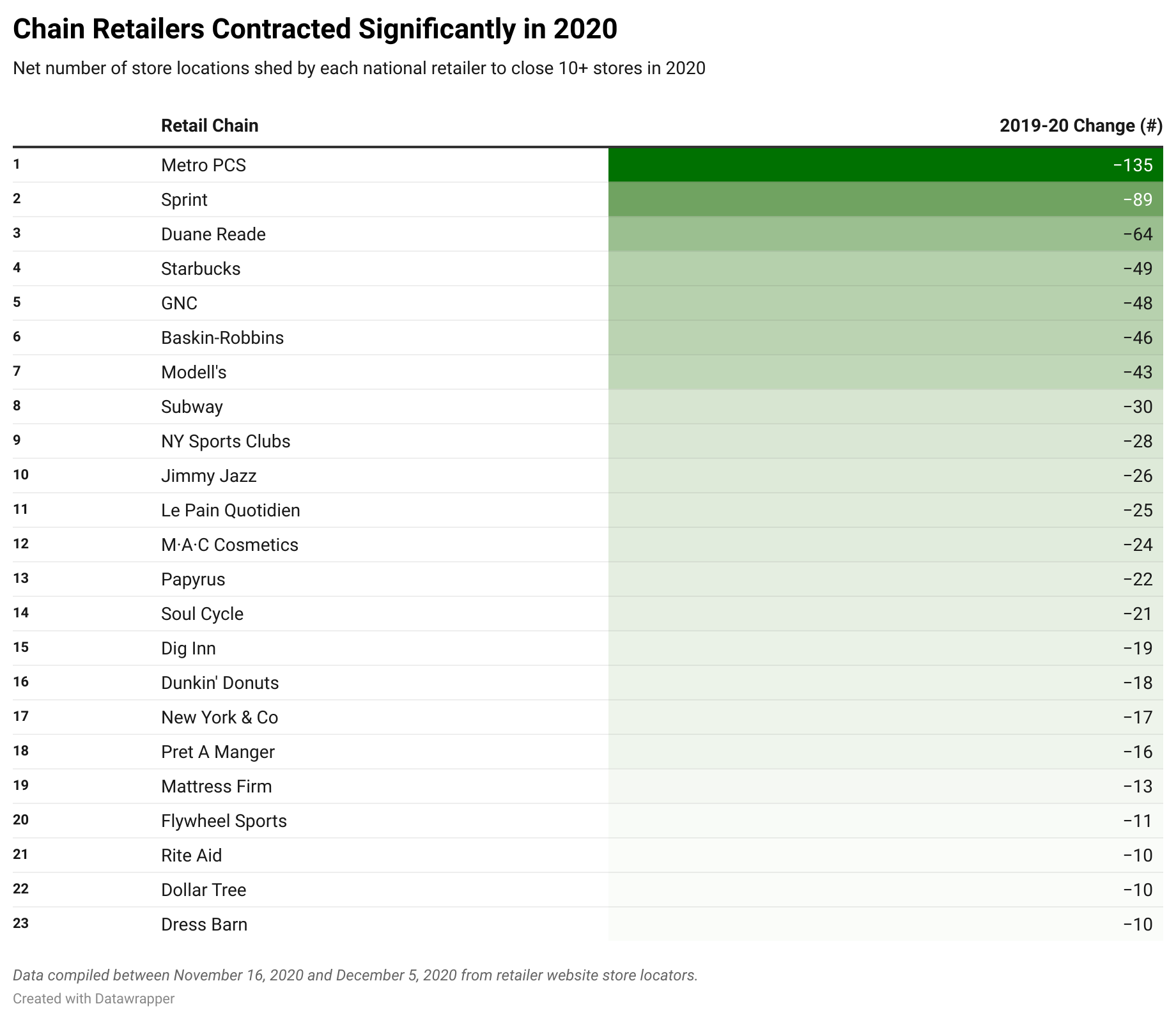

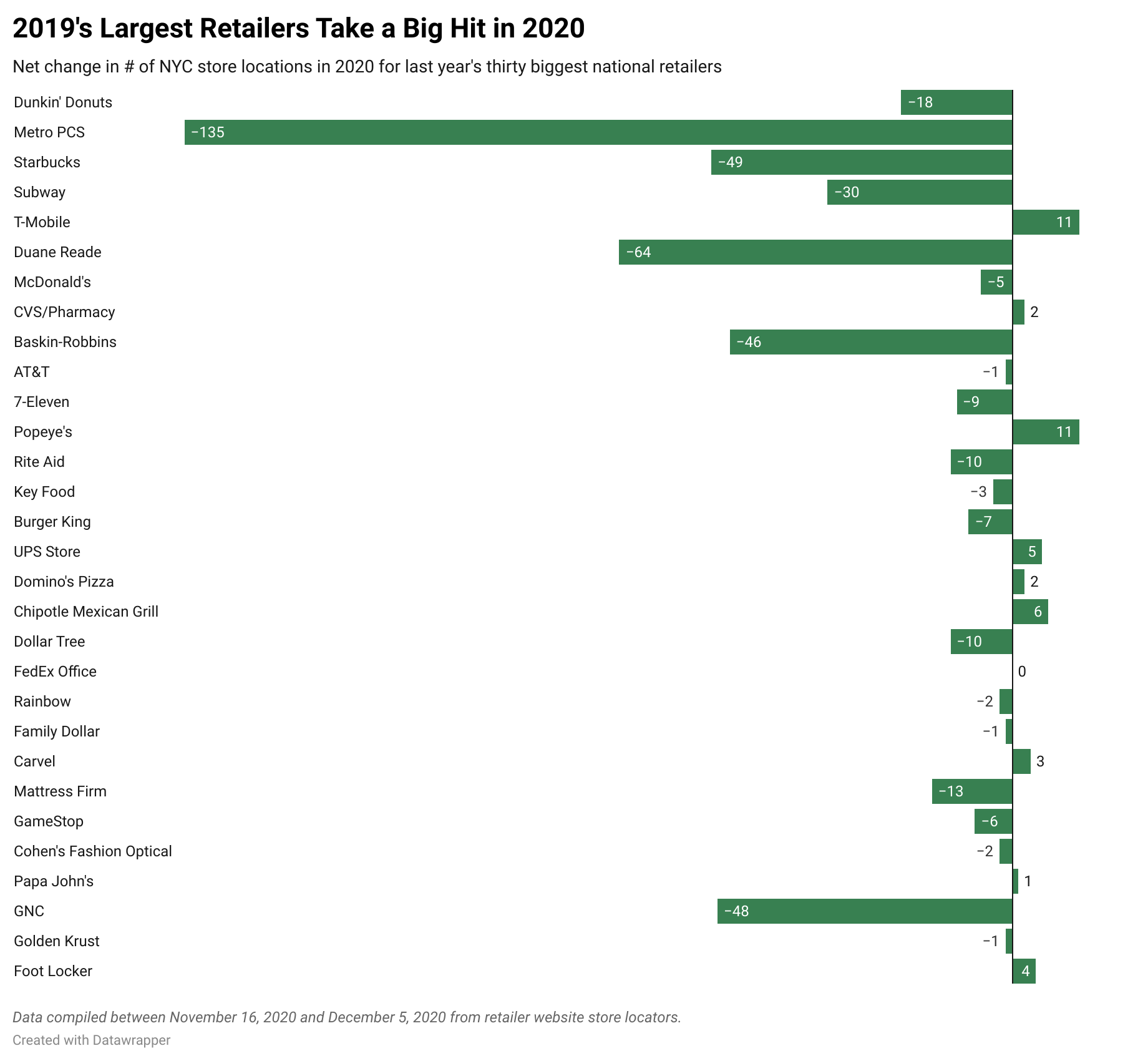

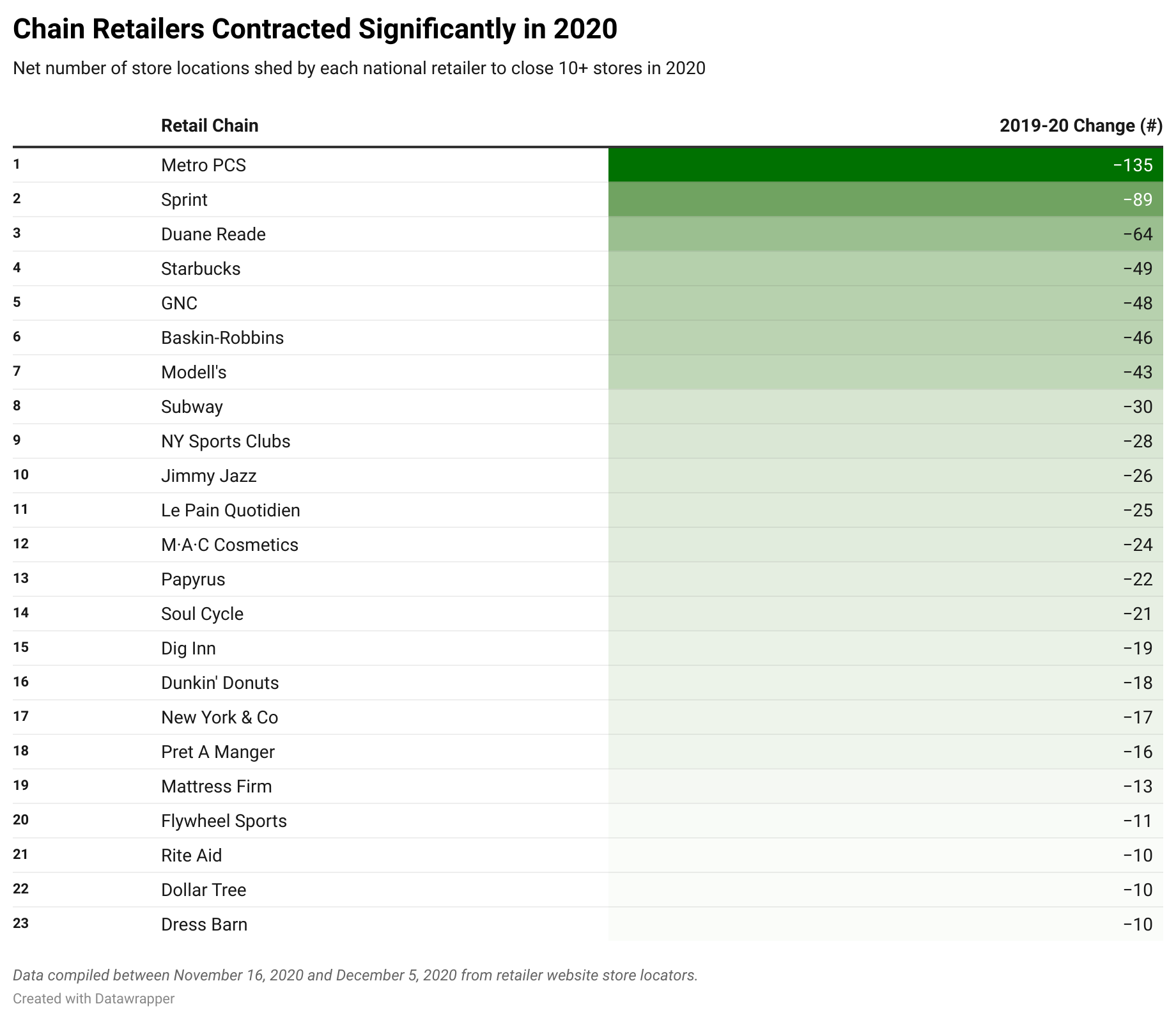

Few retailers avoided store closures. Dunkin’ experienced a year-over-year decline in stores in the city for the first time since we began tracking chain stores thirteen years ago. Although Dunkin’ still has far more store locations in the city than any other national retailer, it has 18 fewer than this time last year. The city’s other big coffee chain, Starbucks, closed even more stores (49). Metro PCS, the city’s second-largest chain retailer, shuttered 135 stores over the past year—a bigger decline than we’ve recorded in any borough since this study began. Meanwhile, Sprint closed all 89 stores, though much of that likely stems from its merger with T-Mobile, which was approved earlier this year.

Other retailers that registered a net loss of at least 15 store locations include: Duane Reade (-64), GNC (-48), Baskin-Robbins (-46), Subway (-30), Modell’s (-43), NY Sports Club (-28), Jimmy Jazz (-26), M·A·C Cosmetics (-25), Le Pain Quotidien (-25), Papyrus (-22), Soul Cycle (-21), Dig Inn (-19), New York & Co. (-17), Pret A Manger (-16), and Mattress Firm (-15). But several of these chains reported significant temporary closures, suggesting that some may bounce back strong next year.

For the first time, our chains analysis includes a category of ‘temporarily closed’ to describe those store locations that retailers themselves indicated on store locators as temporarily shut-down (perhaps as retailers await a vaccine, or rosier economic climate). It is certainly possible that other closures that have taken place are also temporary but were not indicated as such on their store locators.

For example, restaurant chain Dig Inn (-19) has temporarily closed all but six locations, each of which is located in Manhattan. Clothing and accessories retailer Jimmy Jazz (-26) lists all 26 of its New York City locations as temporarily closed. Among health clubs and exercise studios, Soul Cycle (-21) reported significant temporary closures of 18 locations.

Ice cream chain Baskin-Robbins also reports temporary shutdowns in 39 NYC locations.1

For several merchandise retailers selling clothing, shoes, accessories, jewelry, cosmetics, pet supplies, and vitamins, this year’s store closures likely have more to do with growing competition from e-commerce than with problems brought on by the pandemic. Apparel chains BCBG2 (-6), Motherhood Maternity3 (-7), and Justice4 (-6) closed all of their respective New York City locations in the pre-pandemic months. Athletic apparel retailer Modell’s5 shuttered all of its 43 locations after filing for bankruptcy in March. Stationery and greeting card retailer Papyrus announced its shutdown in January, and home décor retailer Pier 16 (-5) shuttered its remaining New York City locations, after filing for Chapter 11 bankruptcy in February. Clothing companies New York & Co.7 (-17), Dress Barn8 (-10), and Thomas Pink9 (-3) each closed all of their New York City locations.

The combination of the pandemic and headwinds from e-commerce prompted many other merchandise retailers to close a significant share of their stores in the city, including:

- M·A·C Cosmetics (from 34 stores to 10 stores), Children’s Place (35 to 28), Aldo (24 to 15), Old Navy (23 to 17), Victoria’s Secret (22 to 13), Gap (28 to 21), Express (10 to 5), Brooks Brothers (9 to 4), Rainbow (61 to 59), V.I.M. (27 to 24), Tumi (13 to 10), Men’s Warehouse (11 to 8), Forever 21 (12 to 9), Lane Bryant (6 to 3), Lids (17 to 15), and Paul Smith (4 to 1)

For most chains, however, store closings were a direct result of the COVID-19 economy. Burger King (-7) announced significant store closures in August, McDonald’s (-5) revealed plans in late July to close hundreds of stores nationally, Le Pain Quotidien (-25) sold its US assets via a Chapter 11 bankruptcy proceeding in May 10, and in September, Flywheel Sports11 (-11) closed all of its 11 NYC locations.

The pullback was broad-based among all sectors, with meaningful declines among sandwich shops, fast food burger chains, ice cream and yogurt chains, as well as among health clubs and exercise studios.

- Perhaps hurt by the decline in office workers eating lunch out, sandwich and soup shops had some of the biggest store reductions. This includes: Subway (from 287 stores to 257 stores), Le Pain Quotidien (from 37 to 12), Pret A Manger (from 56 to 40), Au Bon Pain (from 18 to 11), Potbelly Sandwich Shop (from 15 to 10), and Hale & Hearty Soups (from 19 to 13).

- Several burger chains closed a number of stores, including: McDonald’s (from 203 stores to 198 stores), Burger King (104 to 97), Checkers (34 to 28), Shake Shack (25 to 20), Five Guys (24 to 22), and White Castle (22 to 20).

- COVID-19 restrictions and concern over the spread of the virus led to the closing of number health clubs, studios, and gymnasiums, including: NY Sports Clubs (from 53 stores to 25 stores), Soul Cycle (21 to 0), Flywheel Sports (11 to 0), Rumble (6 to 2), and Tiger Schulmann’s (12 to 11).

- Ice cream and yogurt stores with declines include: Baskin-Robbins (217 stores to 187 stores), Red Mango (14 to 7), Häagen-Dazs (16 to 12), Cold Stone Creamery (9 to 7), Ben & Jerry’s (8 to 6), Pinkberry (11 to 10), Dairy Queen (4 to 3), and Tasti D-Lite (5 to 4).

- Coffee and tea shops with declines include: Starbucks (from 351 stores to 302 stores), Dunkin’ (636 to 618), Kung Fu Tea (27 to 20), Bluestone Lane (19 to 16), David’s Tea (3 to 0), Argo Tea Coffee (4 to 3)

- Juice bars with declines include: Liquiteria (from 5 stores to 0 stores), Juice Press (29 to 26), Pressed Juicery (11 to 10), Jamba Juice (5 to 4).

- Vitamin and food supplements with declines include: GNC12 (from 99 stores to 48 stores) and Vitamin Shoppe (35 to 31).

Perhaps surprisingly, given the economic challenges of the past year, 40 retailers reported a net gain in stores over the past year. Retailers with the biggest increases include Popeye’s (an increase of 11 stores), T-Mobile (+11), Nathan’s Famous (+8), Paper Source (+7), Chipotle Mexican Grill (+6), Sweetgreen (+5), UPS (+5), Foot Locker (+4), Carvel (+3), Wingstop (+3), Lululemon Athletica (+2), Sephora (+2), Whole Foods (+2), Gregory’s Coffee (+2), and Gong Cha (+2).

Popeye’s and T-Mobile were the sole retailer to grow by more than 10 locations this year, with only 43 chains reporting net gains. 117 retailers held steady with no reported changes to their 2019 store totals. These included brands such as: FedEx Office (64 locations), Wendy’s (43), Taco Bell (40), Autozone (38), Foodtown (33), Vivi’s Bubble Tea (31), Marshalls (26), Enterprise (25), Home Depot (21), P.C. Richard & Son (21), Sunglass Hut (19), Danice Stores (18), Party City (18), Auntie Anne’s Pretzels (17), H&M (17), Joe Coffee (17).

Among retail categories, all sectors were impacted by the decline in growth, with only five exceptions, shoes (+5), and home centers, wholesale clubs and jewelry and watches, which saw a gain of just one store each.

Twenty-seven retailers closed all of their locations within the five boroughs, for a net loss of 299 stores, with Sprint (-89) and Modell’s (-43) accounting for most of this decline. Other retailers closing all locations in the city since last year: Papyrus, New York & Co, Dress Barn, Liquiteria, Brooklyn Industries, Pier 1, BCBG Max Azria, Justice, Motherhood Maternity, Pax Wholesome Foods, Johnny Rockets, David’s Tea, Lucky Brand Jeans, Thomas Pink, Billabong, Geox, Strawberry, True Religion, and Flywheel Sports. Jimmy Jazz, Maoz Vegetarian, Bose, Charlotte Russe, and Laila Rowe join this group as well, but with some of their shutdowns listed as temporary closures.

Retailer trends since last year

For the thirteenth consecutive year, Dunkin’ tops our list as the largest national retailer in New York City, with a total of 618 stores, a net decrease of 18 stores since 2019. Metro PCS is still the second-largest national retailer in the city, with 333 stores, despite losing 135 stores over the past year, largely due to their consolidations with parent company T-Mobile. Rounding out the top ten national retailers in New York are Starbucks (with 302 stores), Subway (257), T-Mobile (256), Duane Reade/Walgreens (253), McDonald’s (198), CVS (172), Baskin-Robbins (171) (with a significant 39 temporary closures), and AT&T (135). There are 14 retailers with at least 100 stores across the city, down from 15 last year.

The number of chain stores decreased by 17.4 percent in Manhattan (15.1 percent closed, 2.2 percent temporarily closed), amounting to a total loss of 518 locations, the steepest decline among the five boroughs. Similarly, Brooklyn posted a sharp 12.3 percent decline (10 percent closed, 2.3 percent temporarily closed), losing 214 store locations. One of last year’s slowest-declining boroughs, Staten Island, recorded the slowest decline again in 2020, of 7.6 percent (7 percent closed, 0.6 percent temporarily closed), while the remaining two boroughs, Brooklyn and the Bronx, posted decreases in retailer chains of 9.4 percent (8.9 percent closed and 0.6 percent temporarily closed) and 8.7 percent (7.3 percent closed, 1.4 percent temporarily closed), respectively.

Starbucks has more stores in Manhattan than any other national retailer, with 185 locations. In all other boroughs, Dunkin’ is the top retailer with 190 locations in Queens, 140 locations in Brooklyn, 88 locations in the Bronx, and 37 locations on Staten Island. In fact, Queens, Brooklyn, and the Bronx all share the same list of top three retailers: Dunkin’, Metro PCS, and T-Mobile.

Among the large pharmacy chains, Duane Reade/Walgreens remains the top pharmacy in all five boroughs except Staten Island, where CVS/Pharmacy sits at the top spot. After Dunkin’ Donuts, Subway remains the most popular fast-food chain in Staten Island, although in Queens, it's been surpassed by Baskin Robbins’ 71 locations. Once again, Starbucks is top among all food retailers in Manhattan; in Brooklyn, McDonald’s 50 locations still outpaces Starbucks’s 45 and Subway’s 44.

Borough Trends

Our report also charts retailer trends within the boroughs. We discovered several interesting trends this year:

- Overall, 162 retailers have more of their stores in Manhattan than any other borough, 36 retailers have more of their stores in Queens than any other borough, 28 do in Brooklyn, 7 do on Staten Island, and 6 have the most in the Bronx.

- Only 135 out of the 319 national retailers with locations in New York City had at least one location in the Bronx (42 percent) a sharp decrease from 151 last year. In comparison, 253 (79 percent) have locations in Manhattan, 205 (64 percent) have locations in Brooklyn, 192 (60 percent) have locations in Queens, and 154 (48 percent) have locations on Staten Island.

- Fifty-three retailers have no locations outside Manhattan, the same as last year, with the largest being Just Salad (19 locations), Chopt Salad (18 locations), Bluemercury (16 locations), Le Pain Quotidien (12 locations), and Insomnia Cookies (11 locations).

Every year, we add new national retailers to our ranking; this year, we’ll be adding Magnolia Bakery, Sprinkles, The Palm Restaurant, New Balance, UGG, Peloton, Krispy Kreme, Rag & Bone, Dylan’s Candy Bar, and Lush.

Zip Code Trends

For the second consecutive year in our study, zip code 10001, home to the sprawling Hudson Yards development as well as home to the Manhattan Mall and Herald Square shopping areas, claimed the top place for highest number of national retailer locations at 163 stores, down from 191 in 2019. That distinction used to belong to the 10314 zip code (153 stores), home to the Staten Island Mall, which is down from 171 last year. Manhattan’s East Village 10003 zip code has the third-highest number of chain store locations at 140 (down from 171 last year). Zip code 11201 in Brooklyn Heights/Downtown Brooklyn has the largest number of national retailer locations in that borough at 137, down from 166 last year. In Queens, zip code 11373 in Corona/Elmhurst, home to the Queens Center Mall, has the highest number of chain stores in that borough (123). In the Bronx, zip code 10475, home to the Bay Plaza Shopping Center has the highest number of chain stores of any zip code in that borough (85).

Only eight (3.7 percent) of the city’s 219 zip codes saw increases in the number of chain store locations. The biggest increase was in the 10456 zip code in High Bridge/Morrisania in the Bronx, and in Howard Beach (11414) in Queens, each of which saw a very modest increase of 2 locations.

Notably, zip code 10022 (Midtown East, Manhattan) lost 34 chain store locations, the biggest drop of any zip code. This 23 percent decrease compared to last year is closely followed by zip code 10003 (East Village), which lost 31 locations, and by 11201 (Brooklyn Heights), which lost 30 store locations. In the Bronx, HParkchester (10462) and Baychester/Co-op City (10475) each lost 11 locations, while High Bridge / Morrisania (10451) lost 10 locations. In Queens, 11372 (Jackson Heights) and 11354 (Flushing) earned that distinction, losing 12 locations. 11430 (JFK Airport) saw significant closures as well, of 10 locations, as did 11385 (Ridgewood), 11103 (Astoria), and 11375 (Forest Hills) which each lost 9 In Brooklyn, 11201 (Brooklyn Heights) lost 29 stores, the greatest decline of any zip code in that borough.

Fully 35.5 percent of all national retailer store locations are in Manhattan, while 23.1 percent are in Queens, 22 percent in Brooklyn, 13.2 percent in the Bronx, and 6.1 percent on Staten Island. Over the past six years Manhattan’s share has dropped from 39 percent in 2012 to 35.5 percent in 2020, while Brooklyn’s share has increased from 20 percent to 22 percent.

Manhattan also has the highest concentration of chain stores at 108 locations per square mile. The remaining boroughs have significantly fewer chain stores per square mile: Brooklyn (21), Queens (15), the Bronx (22), and Staten Island (7). Overall there are 23 chain stores per square mile and 1,203 New York City residents for every chain store location in the city.

Click Here to read the full report and view our comprehensive rankings of national chains in New York City by their number of store locations, the number of store locations in each zip code, zip codes with the most and least number of chains, and zip codes with the most and least number of chains by borough.

1. Early in the year, Basin-Robbins expanded significantly, adding more than a dozen new stores across the city. Then, as a result of the pandemic, it temporarily closed 39 stores—including many of the new outlets, along with several of the longstanding locations. Overall, we show a net decline of 46 stores for Baskin-Robbins.

2. “Here’s A List Of 117 Bankruptcies In The Retail Apocalypse And Why They Failed”. Retrieved from: https://www.cbinsights.com/research/retail-apocalypse-timeline-infographic/

3. “Maternity Clothing Store Closing 11 New York Locations: Report”. Retrieved from: https://patch.com/new-york/midhudsonvalley/maternity-clothing-store-closing-11-new-york-locations-report

4. “Justice stores closing 2020: More locations to close as part of Ascena Retail Group bankruptcy. See the new list.”. Retrieved from: https://www.usatoday.com/story/money/2020/09/24/justice-closings-list-tween-stores-liquidating-ascena-coronavirus/3509815001/

5. “Modell’s to close its remaining stores after bankruptcy filing”. Retrieved from: https://nypost.com/2020/03/12/modells-to-close-all-its-remaining-stores-after-bankruptcy-filing/

6. “Pier 1 Imports officially going out of business, closing all stores”. Retrieved from: https://www.nj.com/business/2020/06/pier-1-imports-officially-going-out-of-business-closing-all-stores.html

7. “New York & Company closing all stores in bankruptcy, going-out-of-business liquidation sales now underway”. Retrieved from: https://www.usatoday.com/story/money/2020/07/13/new-york-co-store-closings-rtw-retailwinds-pandemic-bankruptcy/5427367002/

8. “Dressbarn store closings: Liquidation starts Friday at all locations, new website planned”. Retrieved from: https://www.usatoday.com/story/money/2019/10/30/dressbarn-store-closings-2019-all-locations-shutter-dec-26/4104736002/

9. “Thomas Pink shutters London flagship store”. Retrieved from: https://www.retailgazette.co.uk/blog/2020/08/thomas-pink-shutters-london-flagship-store/

10. “24 fast-food and restaurant chains you might see less of in 2021”. Retrieved from: https://www.businessinsider.com/fast-food-restaurant-chains-less-of-in-2021-2020-5

11. “SoulCycle competitor Flywheel files for bankruptcy”. Retrieved from: https://www.cnn.com/2020/09/15/business/flywheel-sports-bankruptcy/index.html

12. “GNC declares bankruptcy, closing 800 stores; complete list of closing locations”. Retrieved from: https://www.al.com/news/2020/06/gnc-declares-bankruptcy-closing-800-stores-complete-list-of-closing-locations.html