Ever feel bogged down by Denver housing talk? Words and acronyms like "affordability," "market-rate" and "AMI" get tossed around as if they were common knowledge.

Meanwhile, housing prices for renters and owners are extremely high, and there's a shortage of rentals and homes for Denverites and the 115,000 newcomers the city has seen in the last decade.

Yeah, it's exhausting.

So, what does affordable mean, and who defines affordability?

"Affordability" might seem subjective, but the United States Department of Housing and Urban Development has a concrete definition: Housing is considered "affordable" when a household spends no more than 30% of its gross monthly income on rent or their mortgage.

The Denver Department of Housing Stability (or HOST) gives this scenario as an example: If an individual earns $43,000 annually, they have a before-tax monthly income of about $3,580. One-third of that would be about $1,200.

According to Britta Fisher, HOST's Chief Housing Officer, households that spend more than 30% of their gross monthly income on housing are considered "cost-burdened because they likely have less money left over for other necessities like food, transportation, healthcare, and discretionary spending."

In Denver, about 115,000 households pay more than 30% of their gross monthly income on housing costs, Fisher said. Of those households, around 48,000 give more than half their income toward housing.

"This makes them severely cost-burdened, and their stability is at far greater risk for losing their housing if any unexpected job loss, medical bill or car repair occurs," Fisher said.

It's important to note that monetary values are all before-tax, or gross, figures. Obviously once taxes are removed, net incomes can be severely reduced, but Fisher said gross incomes are a federal standard method of calculation since taxes differ from state to state.

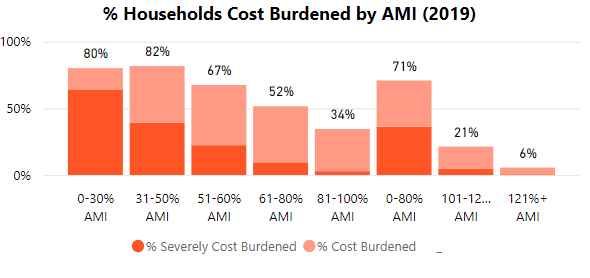

According to city data from 2019, severely cost-burdened individuals typically made between 0-30% of the area median income, or AMI, and 31-51% AMI.

Wait, what's AMI? And why is that used to determine housing income restrictions?

AMI stands for "area median income" and is also determined by HUD, using Census data from the American Community Survey, which collects demographic information yearly.

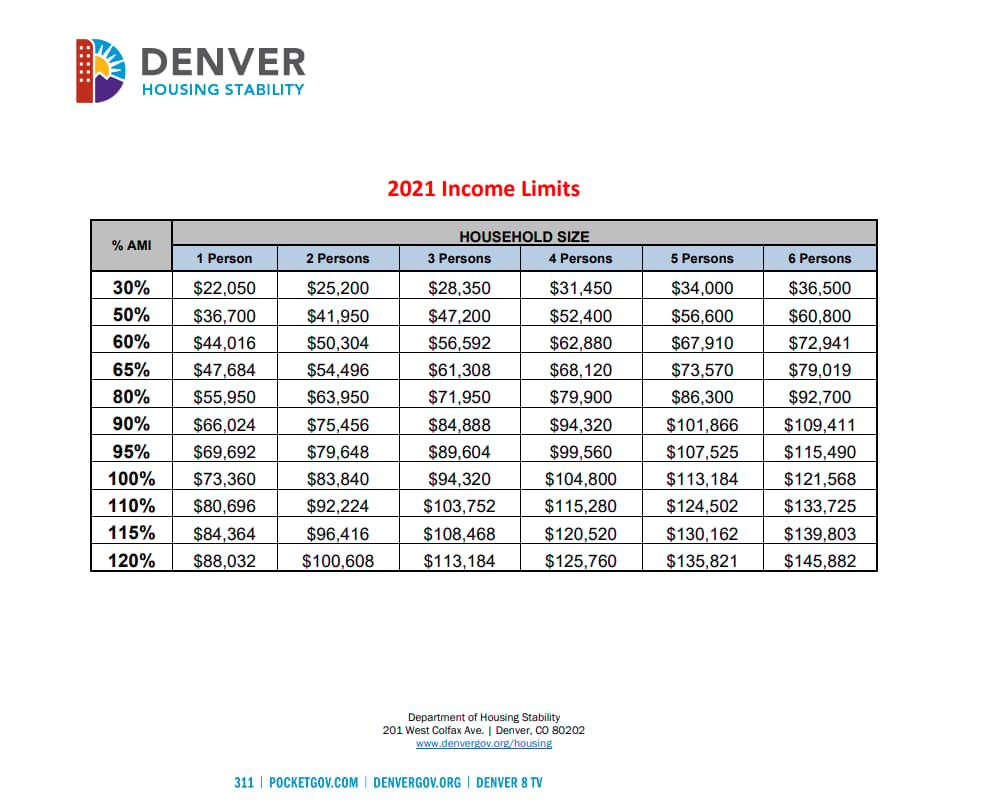

AMI is calculated yearly, and Fisher said new totals for 2022 should be released around April.

According to Fisher, AMI "provides the basis upon which affordability can be determined" because "it represents the midpoint of a region's income distribution at each household size.

"So half of the region's households make more than the median income and half the region's households earn less," Fisher said.

So if you live alone and make around $73,360, you're at 100% AMI.

Median income is not the same as average income. One of the confusing parts of AMI can be the assumption that the "A" stands for average.

Fisher said working with the median number is best because it shows the middle ground across household sizes.

"Most people understand average... they know what the average cost of something is, but most people don't think in a median type of way," Fisher said. "Average would definitely skew numbers. Any large income like Jeff Bezos would throw off the average. Somebody with $200 billion is going to totally dominate the equation compared to the person making $15 an hour."

According to HUD, households at the 80% AMI mark are considered low-income. At 50%, households are considered very low-income, and 30% and under are considered extremely low-income.

According to city data from 2019, about 159,560 households made 100% or less of the area median income. Of those households, about 126,419 made 80% or less AMI.

Meanwhile, only 24,582 units were income-restricted for those making 80% AMI or less.

So, how does Denver become affordable?

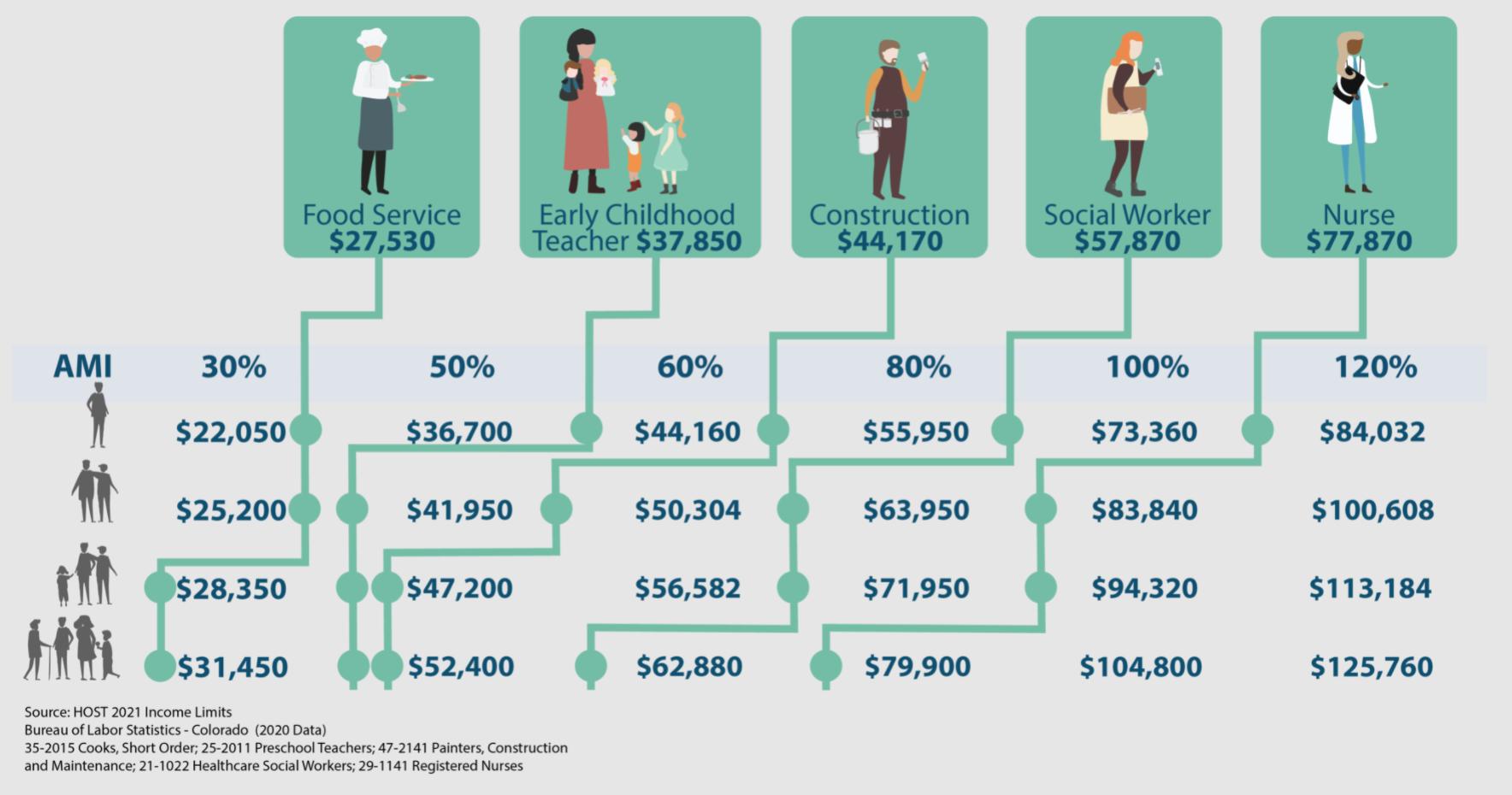

According to HOST, Denver's housing growth over the last 10 years has been geared towards those making 100% AMI and more because Denver's population growth is filled with new residents who make 120% AMI.

Fisher said that's why the city is focusing on finding and creating housing for those in the 80% AMI range and below.

"What we've been feeling in Denver is pressure," Fisher said. "There is less and less naturally occurring affordable housing because it's a very desirable place to be. You have a lot of people who have the ability to afford higher rents than that median point, and it creates that pressure. If you can make more money renting to somebody at a higher amount, the market will say do that. But the workforce needs something that is affordable and there's just not as much of a market demand to make something."

Over the next five years, HOST plans to increase income-restricted homes in Denver from 7% to 8% by creating and preserving "7,000 ownership and rental homes, including the creation of 900 supportive housing apartments," Fisher said.

The department also intends to preserve at least 950 apartments in income-restricted properties and acquire more land to build these affordable units. As far as homeownership goes, HOST wants to increase rates "among low- and moderate-income households from 36% to 41% and the homeownership rate among BIPOC households across income levels from 41% to 45%."

The city has also been working on a plan to push developers to help solve the affordability issue.

"The two-by-fours and the concrete, they all cost the same whether I charge you $1,500 or $5,000 a month," Fisher said.

Have other housing questions? Curious about other housing phrases? Send us a note at [email protected].