President & CEO

Transforming our community is like a journey to the moon: The goal is clear and bright, but getting there is a complex and ever-changing task. When we began our journey toward 10- and 15-year goals in Education, Income/ Financial Stability, Health, and Basic Needs, we knew we’d learn and adapt along the way. Our past impact reports, like this one, prove it. Racial and economic disparities, unique community dynamics, childhood trauma, rising living costs—these and many other factors influence our headway. Our progress and learnings have helped us better understand those factors and where we can deliver the greatest impact. As you read this report and learn about our path forward, I hope you’re excited! And I hope you’ll join us on this epic journey.

WHO WE SERVE

Data represent demographics served in 2018 – 2019.

Our 5-Year Journey

Where We're HEADED

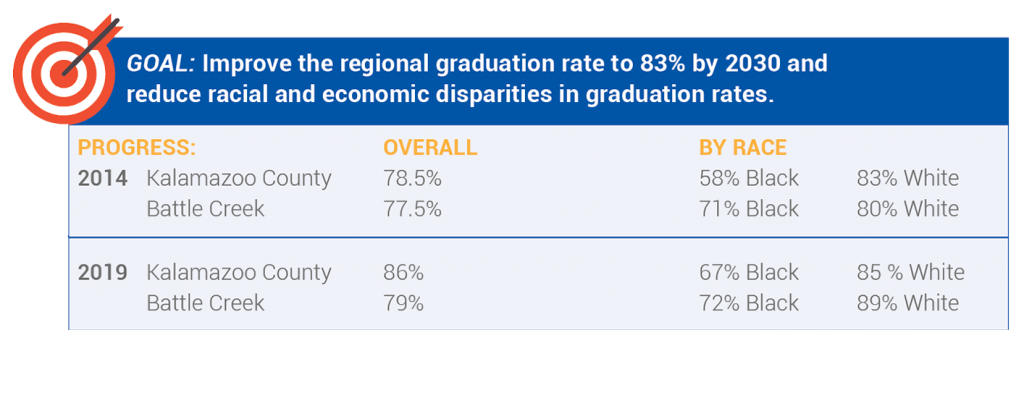

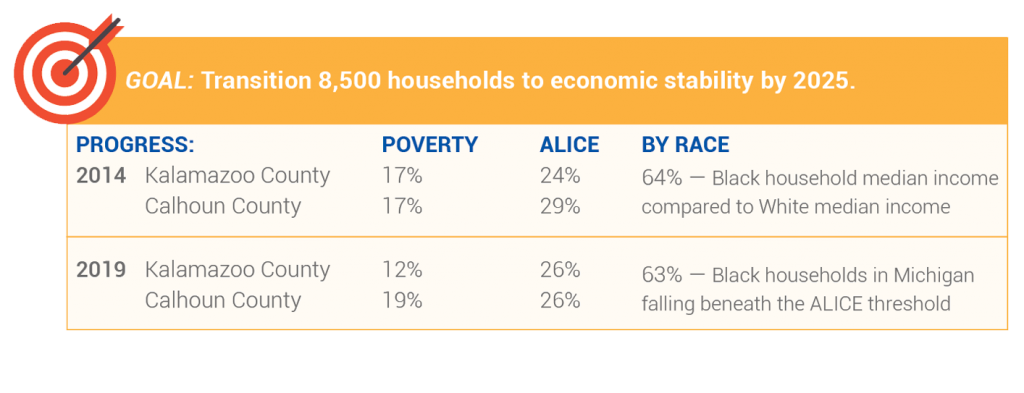

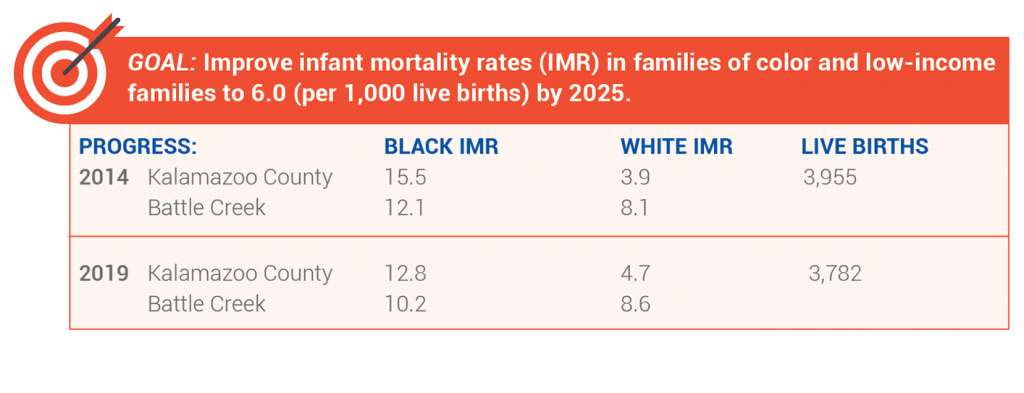

United Way’s strategic impact has evolved to a tighter focus on financial stability and racial disparities. We believe improving the situation for ALICE and BIPOC (Black, Indigenous, People of Color) will accelerate our region’s progress on long-term goals in Education, Financial Stability, Health, and Basic Needs.

Investing in programs that center on specific needs among ALICE and BIPOC neighborhoods and households.

Creating innovative approaches and partnerships that address financial instability and racial disparities, such as small business loans/grants.

Realigning organizational tools, technology, staff capacity, and processes to connect better with partners, donors, grantmakers, influencers, and the region at large.

Engaging policymakers, key stakeholders, volunteers and others through advocacy, issue education, volunteerism

Expanding our leadership role in key initiatives – Catalyzing Community Giving (BIPOC philanthropy), Continuum of Care (homelessness), Disaster Relief (basic needs in crisis).

COVID-19 Response

When the COVID-19 pandemic hit, United Way mobilized quickly to connect partners, raise critical funds and get money to those in need:

DISASTER RELIEF FUND

Individual donors, foundations, community organizations and corporate partners quickly stepped up, allowing United Way to raise and deploy more than $1.725 million to more than 50 different local agencies addressing food, housing, childcare, and financial assistance.

KALAMAZOO SMALL BUSINESS LOAN FUND

United Way and the City of Kalamazoo, with $2 million in funds from the Foundation for Excellence, partnered to launch the Small Business Loan Fund. More than 75 businesses in Kalamazoo accepted a low-interest loan to support them and their employees through the downturn.

KALAMAZOO MICRO-ENTERPRISE GRANTS

KMEG awarded $5,000 grants to 100 of Kalamazoo’s smallest businesses, prioritizing those owned by Black, Indigenous, all People of Color, plus Shared Prosperity neighborhoods. The City of Kalamazoo and United Way partnered with support from Consumers Energy Foundation and the Foundation For Excellence.