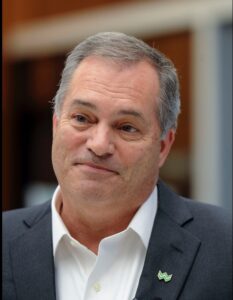

2 min read December 2022 — The 152-year-old WesBanco is an award-winning veteran of the Pittsburgh area’s financial services industry. Invest: spoke with President & CEO Todd Clossin about the ways WesBanco supports its employees and the Pittsburgh community through uncertain times, his expectations for the coming years and the importance of financial literacy and wellness.

2 min read December 2022 — The 152-year-old WesBanco is an award-winning veteran of the Pittsburgh area’s financial services industry. Invest: spoke with President & CEO Todd Clossin about the ways WesBanco supports its employees and the Pittsburgh community through uncertain times, his expectations for the coming years and the importance of financial literacy and wellness.

How does WesBanco contribute to the region?

We have always had a strong history of supporting the communities we serve. When our communities are strong, that makes us strong as well. We’ve been around for 152 years and we were ready to celebrate the 150th anniversary of our founding during 2020 when the pandemic hit. We had a number of planned celebratory activities which we decided to cancel. We took the money that was allocated to those activities and gave it to various community organizations to support them during the early days of the pandemic. There was so much financial uncertainty and insecurity during that time, and we supported our communities the best we could. We have a number of programs related to improving financial literacy, including the America Saves program. We go into schools and teach children to save. We also have a Get Smart About Credit program that we offer, as well as a program for first-time homebuyers. The America Saves program allows people to set financial goals and provides them with financial tools to improve financial literacy. We are fortunate to have received seven consecutive “outstanding” Community Reinvestment Act ratings for our employees’ hard work and dedication to our communities.

What is the difference between being financially literate and having financial wellness?

Financial wellness and financial literacy go hand in hand. It all comes down to having confidence about your financial situation which starts with financial awareness, which is another term for literacy. Improving financial literacy can encompass a number of areas. It could be obtaining knowledge in considering the return on a potential home investment, renting versus buying or ways of building financial security including the use of savings or investment accounts. There are risks and rewards that come along with the financial literacy journey. We make sure we are educating our customers and people in the community to understand safe banking practices, know when to share information and what to be wary about. Financial wellness is the ability to sit back with peace of mind, knowing you have savings to cover a few months of living expenses should the unexpected occur.

What are some of the technological advancements WesBanco is investing in and how are they transforming the banking industry?

We have been continually investing in technology to meet the evolving needs of our customers. Their needs may include access to our products and services through our banking center network, online banking, call centers, and mobile devices. It’s making sure we have the right technology in place to meet customers’ needs when convenient for them. For example, 24/7 banking; people expect it now from banks, as some non-banks have set customer expectations high for banks. Much of our investment goes into that area. On the mortgage side, five or six years ago, you had to go into a banking center or call or e-mail to start a mortgage loan process. Now you can do it online whenever you like and get it turned around pretty quickly. With the new technology, you can watch the progress of the loan without calling to get an update. Those are some things bigger mortgage companies have had for years but now we are making investments to keep pace with them. The ability to turn a debit card on or off at the time of your choosing is a new feature for us this year. These features are going to continue to evolve, making it easier and more convenient for the customer. Good customer experience should cross over platforms so the various service channels are connected, allowing a 360 view of the customer.

How would you describe the demand for services?

Two years ago, as so many deposits came into the banking industry, along with stimulus payments that were being sent out by the government, there was a need for deposit services.. There was the PPP loan process, among other things. We were providing customers with short-term payment deferral options, suspending their payments until they could get back to work. Then as a vaccine was discovered and economic activity started building back up, PPP loan support and loan deferral activity started returning to normal. Now, with all that liquidity that was put into the system, we are seeing inflation, making it harder for people to buy homes or cover daily expenses. Interest rates are going up dramatically. In the second quarter of this year, the banking industry had its strongest loan growth in a decade. Now, I think, there is a shift toward caution because there will be some sort of an economic slowdown. We’re not seeing as many residential mortgage loan applications as before. People are waiting for interest rates or home prices to come down, maybe both. The longer inflation continues, the harder it is for customers. The higher cost of living affects what they need from their bank. Lower credit quality hasn’t shown up yet but it will if interest rates stay high for too long. People are not pessimistic but cautious. All that shows up in our products and the demand for them.

What is your outlook for the next two to three years?

I feel pretty good about things long term. I think I’m a realist. This country is in great shape and consumers have held up pretty well to date. We have issues to tackle but as a country, we find ways to come together and get through them. There is a great deal of pent-up demand and that will show up in stronger economic growth once we get inflation under control. As soon as inflation is back down in that 2-3% range and interest rates are down as well, then I think the economy will begin to strengthen.

I’m very bullish, and our bank has growth plans ahead. The future looks bright.

For more information, visit: