California Road Repair and Accountability Act of 2017

- General election: Nov. 6

- Voter registration deadline: Oct. 22

- Early voting: Oct. 8 - Nov. 5

- Absentee voting deadline: Postmark Nov. 6

- Online registration: Yes

- Same-day registration: Yes

- Voter ID: No

- Poll times: 7:00 a.m. to 8:00 p.m.

| Tax policy in California | |

| Tax rates in 2017 | |

| Personal income tax: 1% to 13.3% | |

| State sales tax: 7.25% | |

| Corporate income tax: 8.84% | |

| Tax revenues in 2017 | |

| Total tax collections: $155.63 billion | |

| Tax collections per capita: $3,936 | |

| Total state expenditures • State debt • California state budget and finances | |

The California Road Repair and Accountability Act of 2017 (RRAA), also known as Senate Bill 1 (SB 1), was enacted into law on April 28, 2017. The RRAA increased transportation-related taxes and fees, including the gas excise tax, diesel excise tax, and diesel sales tax, and was designed to dedicate the revenue to transportation infrastructure. The increased taxes went into effect on November 1, 2017.[1] According to the state Senate Appropriations Committee, the RRAA was expected to generate an estimated $5.2 billion per year or $52.4 billion between 2017 and 2027.[2]

In the California State Legislature, the RRAA had the support of most Democrats (two legislators voted "no"). Most Republicans voted against the RRAA (one legislator voted "yes").[1] Gov. Jerry Brown (D) signed the legislation into law, saying, "Safe and smooth roads make California a better place to live and strengthen our economy. This legislation will put thousands of people to work."[3]

Republicans campaigned against the bill, with gubernatorial and congressional candidates backing a ballot initiative to repeal the RRAA. The campaign committees of Speaker of the House Paul Ryan (R-Wis.), House Majority Leader Kevin McCarthy (R-Calif.), and House Majority Whip Steve Scalise (R-La.) had all contributed to the initiative campaign. The California Republican Party and gubernatorial candidate John Cox had also contributed to the campaign.[4] At the state GOP convention in 2018, Carl DeMaio (R), a former member of the San Diego City Council, said, "As you know, repealing the car and gas tax is the hottest issue in California and we want to make sure we use this ballot initiative as a way to draw Republicans and elect Republicans in the November election."[5] On November 6, 2018, voters rejected the ballot initiative to repeal the tax.[6]

Republicans also initiated a recall against Sen. Josh Newman (D-29) for voting for the RRAA. On June 5, 2018, voters ousted Sen. Newman in the recall election and replaced him with Republican Ling Ling Chang. DeMaio celebrated the outcome, stating, "Sacramento politicians must be flipping out in panic. Not only are we going to repeal the tax, but it’s going to kick several politicians out of Sacramento." Gov. Brown's spokesman Evan Westrup responded to DeMaio, saying, "Carl and his fellow Trumpites don’t care about California’s crumbling roads and horrible congestion, but the voters of California do. See you in November."[7]

Aftermath

Proposition 6

In September 2017, a ballot initiative was proposed that would have the effect of repealing the Road Repair and Accountability Act of 2017 (RRAA). Supporters were required to collect 585,407 valid signatures for the initiative. On April 30, 2018, the campaign in support of the initiative, Give Voters a Voice, reported that supporters filed 963,905 signatures.[8][9][10] Counties had until June 25, 2018, to conduct a random sample of signatures. The ballot initiative was certified for the ballot and assigned the official title Proposition 6. On November 6, 2018, voters rejected Proposition 6.[11]

As of 2018, increasing a tax in California required a two-thirds vote of each state legislative chamber and the governor's signature. The ballot initiative would have created the additional step of voter approval (via a ballot proposition) to impose, increase, or extend fuel taxes or vehicle fees. The requirement that tax increases receive voter approval would have affected taxes and tax rates enacted after January 1, 2017, meaning fuel taxes and vehicle fees that were created or increased in 2017 or 2018 would have been repealed. This would have had the effect of repealing the RRAA.

Recall of state Sen. Newman

Sen. Josh Newman (D-29) was recalled on June 5, 2018.[12] Ling Ling Chang (R), Newman's opponent in 2016, was elected to replace him. Because Newman was recalled and replaced by a Republican, Democrats lost their two-thirds supermajority in the California State Senate.

Carl DeMaio, chairman of Reform California and a former member of the San Diego City Council, launched the campaign to recall Sen. Newman in response to his support of the Road Repair and Accountability Act of 2017 (RRAA). Supporters of the recall effort collected more than 63,593 signatures. On August 18, 2017, enough signatures were verified for the recall election to occur.[13] On January 8, 2018, the governor announced a recall election for June 5, 2018.[14]

Sen. Newman was first elected to represent District 29 in the California State Senate on November 8, 2016. He defeated former Rep. Ling Ling Chang (R).

California Proposition 69

On June 5, 2018, 81 percent of voters in California approved Proposition 69. Proposition 69 required that revenue from the diesel sales tax and Transportation Improvement Fee enacted by Senate Bill 1 (SB 1) be used for transportation-related purposes.[15]

Proposition 69 was part of a legislative package that included the Road Repair and Accountability Act of 2017 (RRAA). All legislative Democrats, along with two legislative Republicans, voted to refer the proposal to the ballot.[15]

Without the RRAA, Proposition 69 would not have affected anything. Prior to Proposition 69, the state constitution required the legislature to use gasoline excise tax revenue or diesel excise tax revenue for transportation purposes. However, the state constitution did not require revenue from the diesel sales tax to be used for transportation purposes. Proposition 69 placed similar restrictions on how the revenue from the diesel sales tax could be used. The measure also required the TIF revenue be spent on public streets and highways and public transportation systems. Although the RRAA required revenue from the zero-emission vehicles fee to be placed in a Road Maintenance and Rehabilitation Account, Proposition 69 did not contain a provision creating a constitutional mandate for zero-emission vehicles fee revenue.[15]

Polls

USC Dornsife and the Los Angeles Times polled registered voters on whether to keep or repeal Senate Bill 1 (SB 1). The first poll was conducted in October and November 2017 and indicated that 46 percent wanted to keep and 54 percent wanted to repeal SB 1. The bill had the support of 55 percent of Democrats, 50 percent of independents, and 25 percent of Republicans.[16] The second poll was conducted in April and May 2018 and estimated that 38 percent wanted to keep and 51 percent wanted to repeal the tax increase. The bill had the support of 49 percent of Democrats, 43 percent of independents, and 12 percent of Republicans.[17]

| California Road Repair and Accountability Act of 2017 | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Keep | Repeal | Undecided | Margin of error | Sample size | ||||||||||||||

| USC Dornsife/Los Angeles Times 4/18/2018 - 5/18/2018 | 38.0% | 51.0% | 11.0% | +/-4.0 | 691 | ||||||||||||||

| USC Dornsife/Los Angeles Times 10/27/2017 - 11/06/2017 | 46.0% | 54.0% | 0.0% | +/-4.0 | 1,504 | ||||||||||||||

| AVERAGES | 42% | 52.5% | 5.5% | +/-4 | 1,097.5 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

RRAA Revenue

The California Road Repair and Accountability Act of 2017 (RRAA) increased transportation-related taxes and fees. The tax increases went into effect on November 1, 2017. Other than the diesel sales tax, the RRAA was designed to adjust the tax and fee rates based on annual changes in the California Consumer Price Index (CPI). The following is a list of taxes and fees that were created or increased:[1]

- Gas Excise Tax: The RRAA increased the gas excise tax $0.12 cents per gallon, from $0.297 cents per gallon to $0.417 cents per gallon.

- Diesel Excise Tax: The RRAA increased the diesel excise tax $0.20 cents per gallon, from $0.16 cents per gallon to $0.36 cents per gallon.

- Diesel Sales Tax: The RRAA increased the sales tax on diesel fuels by an additional 4 percentage points, from 9 percent to 13 percent.

- Zero-Emission Vehicles Fee (ZEV): The RRAA created an annual $100 per vehicle fee for owners of zero-emission vehicles (ZEV) model years 2020 or later. ZEV was slated to go into effect on January 1, 2020.

- Transportation Improvement Fee (TIF): The RRAA enacted a new annual fee based on the market value of vehicles. TIF went into effect on January 1, 2018.

| California Transportation Improvement Fee (TIF) | |||

|---|---|---|---|

| Fee | Market Value | ||

| $25 | $0-$4,999 | ||

| $50 | $5,000-$24,999 | ||

| $100 | $25,000-$34,999 | ||

| $150 | $35,000-$59,999 | ||

| $200 | $60,000 or higher | ||

RRAA Appropriations

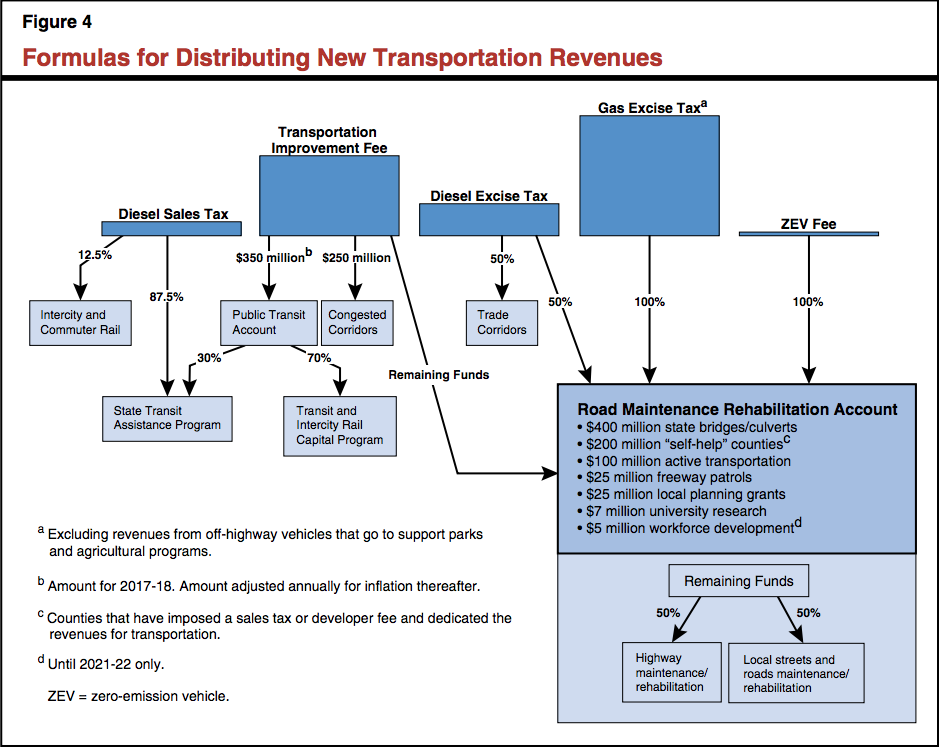

The Road Repair and Accountability Act of 2017 (RRAA) provided for the allocation of revenue from the tax and fee increases to specific funds and programs. The California Legislative Analyst’s Office issued the following diagram to illustrate how the revenue would be spent, according to the legislation:[2]

Road Maintenance and Rehabilitation Program

The RRAA created the Road Maintenance and Rehabilitation Program (RMRP), which was expected to receive an estimated $3.24 billion per year. The RMRP was designed to receive revenue from the gasoline excise tax, excluding revenue from gasoline for off-road vehicles, half of the diesel excise tax ($0.10), the zero-emission vehicles fee, and revenue over $600 million from the Transportation Improvement Fee. The bill required RMRA funds to be distributed as follows:[1][2]

| Road Maintenance and Rehabilitation Program (RMRP) | |||

|---|---|---|---|

| Allocation | Purpose | ||

| $400 million | maintain and repair state bridges and culverts | ||

| $200 million | counties with voter-approved taxes and fees for transportation improvements | ||

| $100 million | Active Transportation Program, which is tasked with bicycling and pedestrian improvement projects | ||

| $25 million | freeway service patrol program to remove disabled vehicles from freeways | ||

| $25 million | local and regional transportation planning grants | ||

| $7 million | transportation research | ||

| $5 million | transportation-related workforce education, training, and development | ||

| after above is allocated, 50% of remaining funds | state highway system maintenance | ||

| after above is allocated, 50% of remaining funds | local streets maintenance | ||

Trade Corridor Enhancement Account

The RRAA was designed to deposit half of the diesel excise tax ($0.10) into the Trade Corridor Enhancement Account (TCEA) to fund corridor-based freight projects. TCEA was expected to receive an estimated $310 million per year.[1][2]

Solutions for Congested Corridors Program

The Solutions for Congested Corridors Program (SCCP) was slated to receive $250 million per year from the Transportation Improvement Fee. The RRAA required SCCP to distribute funds to projects that address transportation, environmental, and community access improvements within highly congested-travel corridors throughout the state.[1][2]

Transit and Intercity Rail Capital Program

The RRAA provided the Transit and Intercity Rail Capital Program (TIRCP) with 70 percent of $350 million from the Transportation Improvement Fee. TIRCP was a competitive grant program that awards funding for transit and rail capital projects.[1][2]

State Transit Assistance Program

The RRAA was designed to provide the State Transit Assistance Program (STAP) with 30 percent of $350 million from the Transportation Improvement Fee and 87.5 percent of the revenue from the diesel sales tax for about $430 million a year. STAP provided funding for transit operators.[1][2]

Intercity and Commuter Rail

The RRAA created a new stream of revenue for intercity rail operations and projects from 12.5 percent of the diesel sales revenue tax for a total of about $44 million per year.[1][2]

Department of Parks and Recreation and Department of Food and Agriculture

The RRAA was designed to distribute revenue from the gas tax increase received from off-highway vehicles and boats to the state Department of Parks and Recreation and revenue from the gas tax increase received from agricultural vehicles to the state Department of Food and Agriculture.[1][2]

RRAA in the California State Legislature

The Road Repair and Accountability Act of 2017 was passed on April 6, 2017. The RRAA required a two-thirds vote in each chamber of the California State Legislature. The state Senate voted 27-11 to pass the bill. Democrats controlled 27 seats in the state Senate, just enough to pass the bill. However, Sen. Steve Glazer (D-7) joined Republicans to oppose the RRAA. Sen. Anthony Cannella (R-12) joined Democrats to approve the RRAA, giving the bill 27 votes.[1]

Senate President Kevin de León (D-24) praised the legislation, saying, "Today, after decades of inaction, the legislature approved a fiscally responsible plan to address our decrepit transportation infrastructure. This bipartisan compromise includes strict accountability measures and closes our massive transportation funding shortfalls — without burdening future generations with debt."[18] Senate Minority Leader Patricia Bates (R-36) criticized the bill, stating, "It didn't have to be this way. Senate Republicans put forth our own transportation plan that would have provided $7.8 billion for our crumbling roads without raising taxes. Instead, drivers will be paying more to fund not just road repairs that could have been paid for with existing dollars, but also other projects such as bike trails and potentially high-speed rail."[19]

Likewise, the state Assembly approved the RRAA with no votes to spare. The bill passed 54-26. Democrats controlled 55 seats in the state Assembly. Rep. Rudy Salas (D-32) joined Republicans to oppose the RRAA, leaving Democrats with just enough members to approve the legislation.[1]

Speaker of the Assembly Anthony Rendon (D-63) said, "Supporting SB 1 required a combination of common sense, political courage, and concern for the Californians who drive on our roads and bridges."[20] Assembly Minority Leader Chad Mayes (R-42), critical of the bill, stated, "Gov. Brown and Capitol Democrats just gave us the largest gas tax increase in state history — a deal so bad they needed $1 billion in pork to buy the votes to pass it."[20]

Gov. Jerry Brown (D) signed the legislation into law on April 28, 2017.[21]

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

See also

- California 2018 ballot propositions

- California Proposition 6, Voter Approval for Future Gas and Vehicle Taxes and 2017 Tax Repeal Initiative (2018)

- California Proposition 69, Transportation Taxes and Fees Lockbox and Appropriations Limit Exemption Amendment (June 2018)

- California gubernatorial election, 2018

- United States House of Representatives elections in California, 2018

- California State Senate elections, 2018

- California State Assembly elections, 2018

- Josh Newman recall, California State Senate (2018)

Footnotes

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 California Legislature, "Senate Bill 1," accessed April 7, 2017

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 California Legislative Analyst's Office, "Overview of the 2017 Transportation Funding Package," accessed January 9, 2017

- ↑ Office of the California Governor, "Governor Brown Signs Landmark Transportation Funding Package," April 28, 2017

- ↑ Cal-Access, "Campaign Finance," accessed March 8, 2018

- ↑ Los Angeles Times, "House Speaker Paul Ryan, Majority Whip Steve Scalise contribute to initiative to repeal California's gas-tax increase," May 2, 2018

- ↑ CBS Sacramento, "Proposition 6, California Gas Tax Repeal, Fails," November 6, 2018

- ↑ The San Diego Union-Tribune, "Gas tax repeal fuels Republican candidates in primary election," June 7, 2018

- ↑ NBC Los Angeles, "Gas Tax Repeal Initiative Qualifies for November Ballot," April 25, 2018

- ↑ KRON 4, "Conservatives turn in 940,000 for anti-gas tax initiative," April 30, 2018

- ↑ KTVU, "Effort to repeal California gas tax rolls forward," April 30, 2018

- ↑ The Desert Sun, "California Proposition results: Voters reject gas-tax repeal, defeat Prop. 6," November 7, 2018

- ↑ Los Angeles Times, "Sen. Josh Newman, targeted by the GOP for his gas-tax vote, will face recall election on June 5," January 8, 2018

- ↑ The Sacramento Bee, "California senator recall organizers have enough signatures," August 18, 2017

- ↑ KPCC, "June 5 set for California state Sen. Josh Newman recall election," January 8, 2018

- ↑ 15.0 15.1 15.2 California Legislature, "Assembly Constitutional Amendment 5," accessed April 7, 2017

- ↑ Los Angeles Times, "Most California voters already want to overturn gas tax increase, poll finds," November 10, 2017

- ↑ USC Dornsife, "Voters want gas tax repealed, have mixed feelings about high-speed rail before knowing estimated costs," May 25, 2018

- ↑ Desert Sun, "California's gas tax will hit 30 cents per gallon in January," April 7, 2017

- ↑ California Senate Republicans, "Senate Republican Leader Bates' Statement on Gas & Car Tax Increase," November 1, 2017

- ↑ 20.0 20.1 Los Angeles Times, "Gov. Brown signs bill raising gas tax and vehicle fees by $5.2 billion annually for road and bridge repairs," April 28, 2017

- ↑ The Sacramento Bee, "Gov. Brown signs gas tax increases," April 28, 2017